A Whopping Election-Related Implied Vol Skew Does Exist – Just Not in SPY

October 24, 2024

The Markets at a Glance

SPY and QQQ have put together several down days in a row now, handing us at least a minor correction of some sort. Without any major new economic news, it could be a bit of angst ahead of upcoming earnings reports. Or, it could simply be a garden variety pull-back from recent highs as players lock in profits and adjust their portfolios before the election.

From a chart perspective, I see the possibility of exhaustion from recent buying in the shape of a large wedge since mid-August. The market cannot sustain a trend like that and will often fall out of the wedge at the end.

I also note that the upward move from early August set three successive new highs in mid-August, mid-September, and now mid-October respectively, each followed by successively smaller pullbacks. So there has been a buy-the-dip orientation these past three months that has propelled SPY up more than 18% from the August low – a rally that would still be a healthy one, even if it gave back half of that.

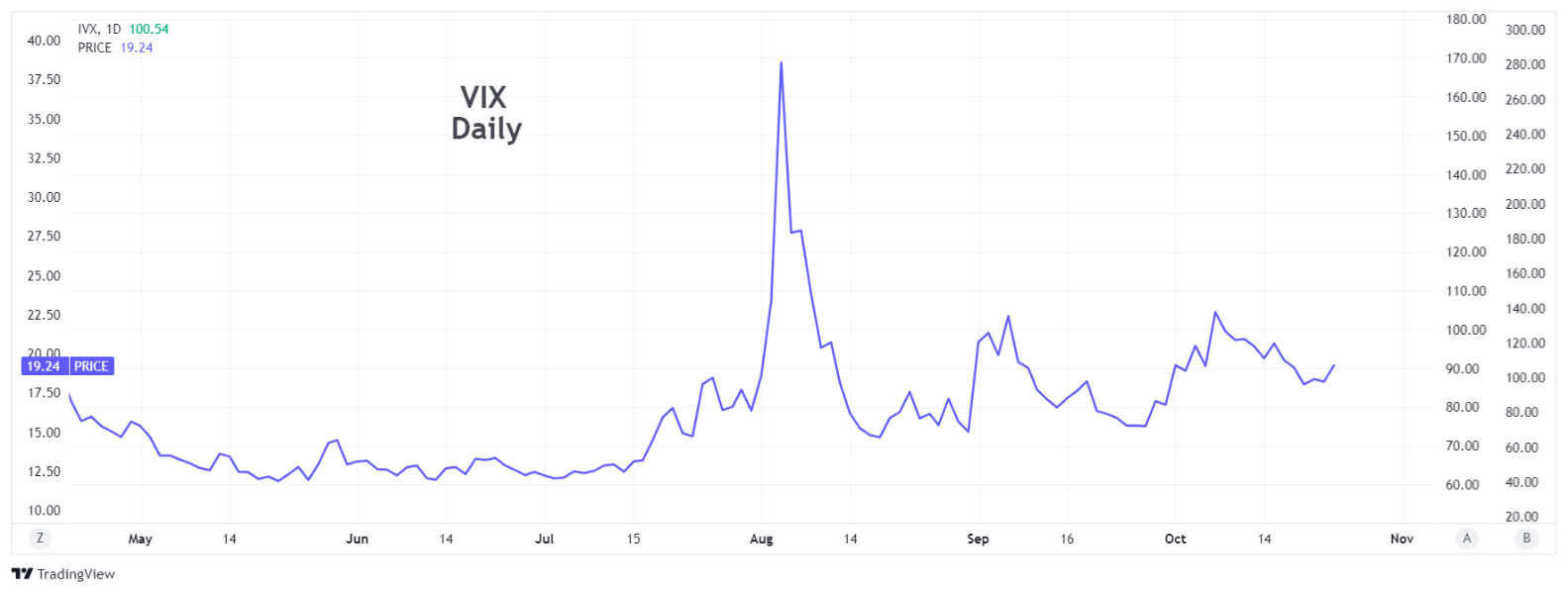

VIX climbed back above 20 Wednesday but did not hold there, closing at 19.2. So, the pull-back so far has not ignited a new level of fear. But selling begets selling just as buying begets buying and I suspect that many investors realize that the market has likely priced in the good news about a soft landing and they are now looking at other criteria to justify any further buying.

Absent the momentum of successive new highs, I see a lot of attention shifting to election-related trading rather than economy-driven trading. There is already plenty of anecdotal evidence that institutions and hedge funds are positioning themselves for either a Trump or Harris win as they see it. That can move individual companies but does not appear to be having a discernible effect on the broad indexes.

In fact, however, there is a notable election-related IV skew – just not in SPY.

Strategy Talk: The Election-Related Implied Volatility Skew is Not in SPY

The skew I am referring to is in DJT – Trump Media and Technology Group Corp. With little revenue thus far or assets other than cash, the entity seems to have taken on a role as a betting proxy on Trump's fate in the election.

There is really no economic justification for the stock's current price of 35.91 other than the hope that Trump will get elected and the enterprise will suddenly become worth even more – or that Trump will not be elected and it will be next to worthless.

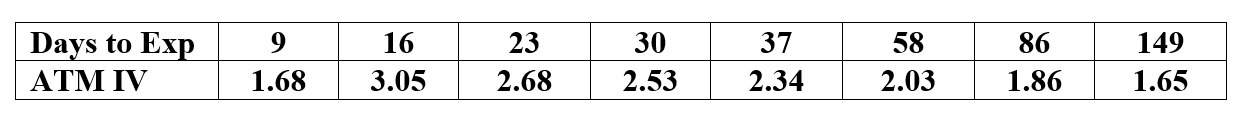

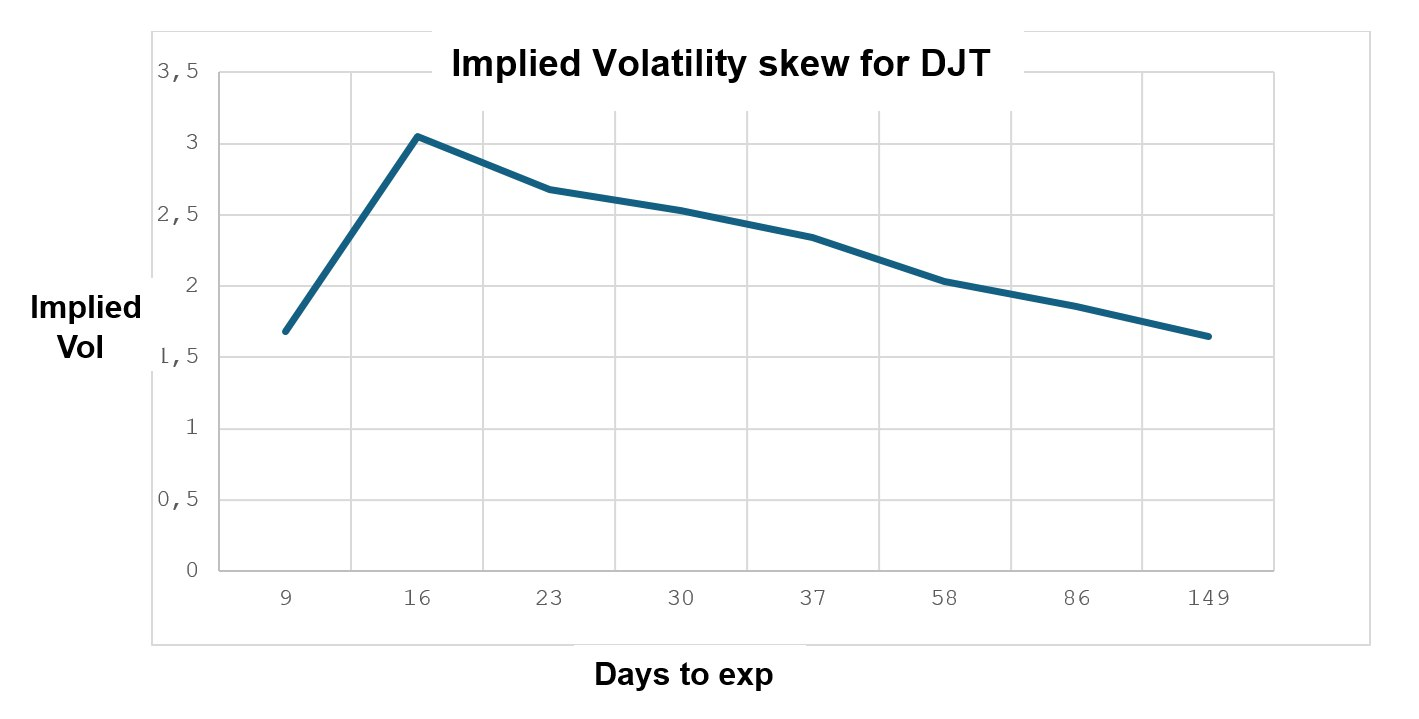

The options on DJT tell a wild story. While thinly traded, they are priced at a near-term implied volatility (one week) of 1.68. That's similar to the IV of the same call (36 strike) 5 months from now. But if you look at the two-week call (which expires right after the election), the IV nearly doubles to 3.05. Other expirations are shown in the table below.

A chart of the above values readily shows the skew.

While a great example of an IV skew and very richly priced options, it makes for an interesting observation but a questionable trade. That's partially because the options are not very liquid and would therefore be challenging to trade, but also because there is no economic justification one could point to for either a very high or very low price.

The stock seems to have become a gambling instrument, similar to the legalized election bets that are also being made on each candidate.

I looked at a variety of possible trades, but the liquidity is a big hindrance to anything other than a simple covered call write in my estimation. If you feel the stock still has upside after the election, you could buy the stock and sell a 30 or 35-strike call in November for a very attractive potential return if assigned.

But there are no fundamentals to support prices anywhere near current levels and the stock was as low as 11.75 only a month ago. Put prices, however, are equally outrageous, and even less liquid.

One thing that you can count on is the implied volatility dropping right after the election. To capitalize on the skew and maintain a neutral position on direction, you would need to buy a straddle or strangle for say January and sell the same strikes for November. Buying the Jan 35 straddle would cost around 25.20 and selling the same straddle for Nov 15th would take in around 19.20. That means you would lay out about 6 points.

But who knows what the stock will do after the election under either win scenario? And who knows what the plans for this company would be under either scenario? Personally, I intend to watch this one from the sidelines and just take notes.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.