When Broader Stocks Are Lagging

June 21, 2024

The Markets at a Glance

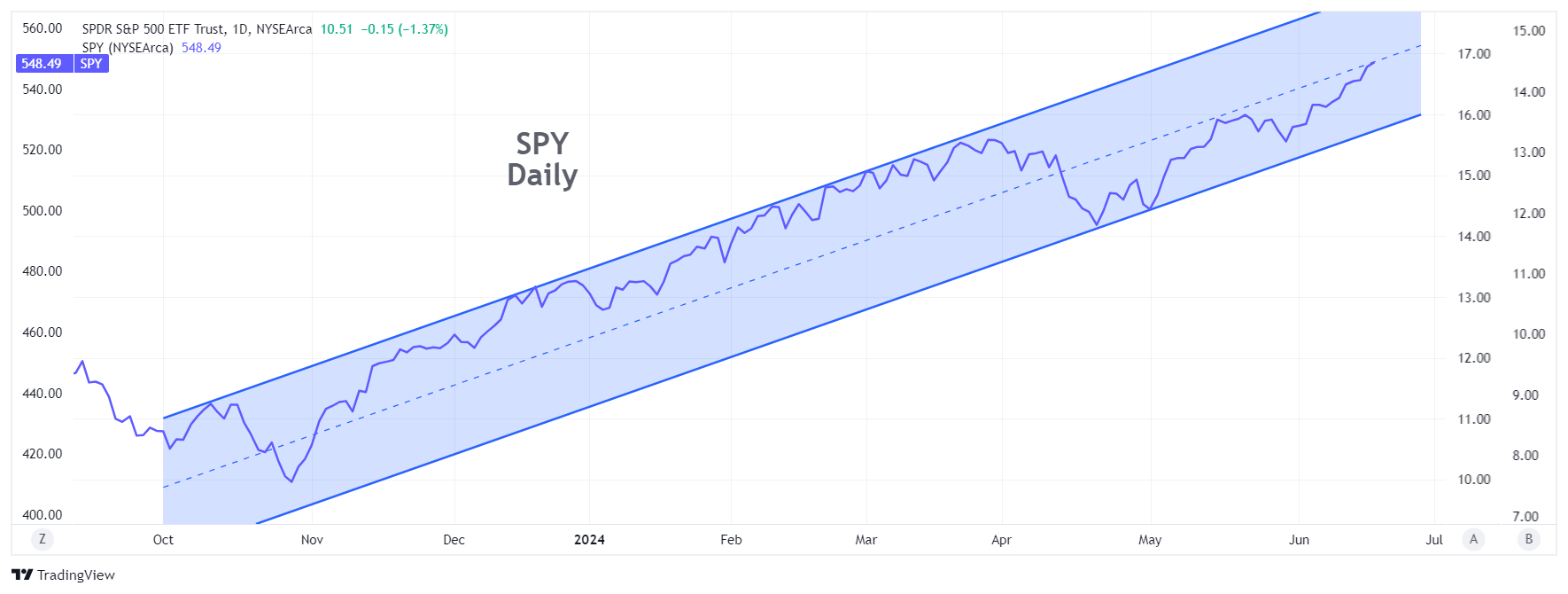

The SPY and QQQ ETFs hit new highs this week at Tuesday's close, continuing their upward momentum since last October. But as they did, more and more market technicians are pointing out that the rally is being kept alive by a thinning number of large-cap stocks.

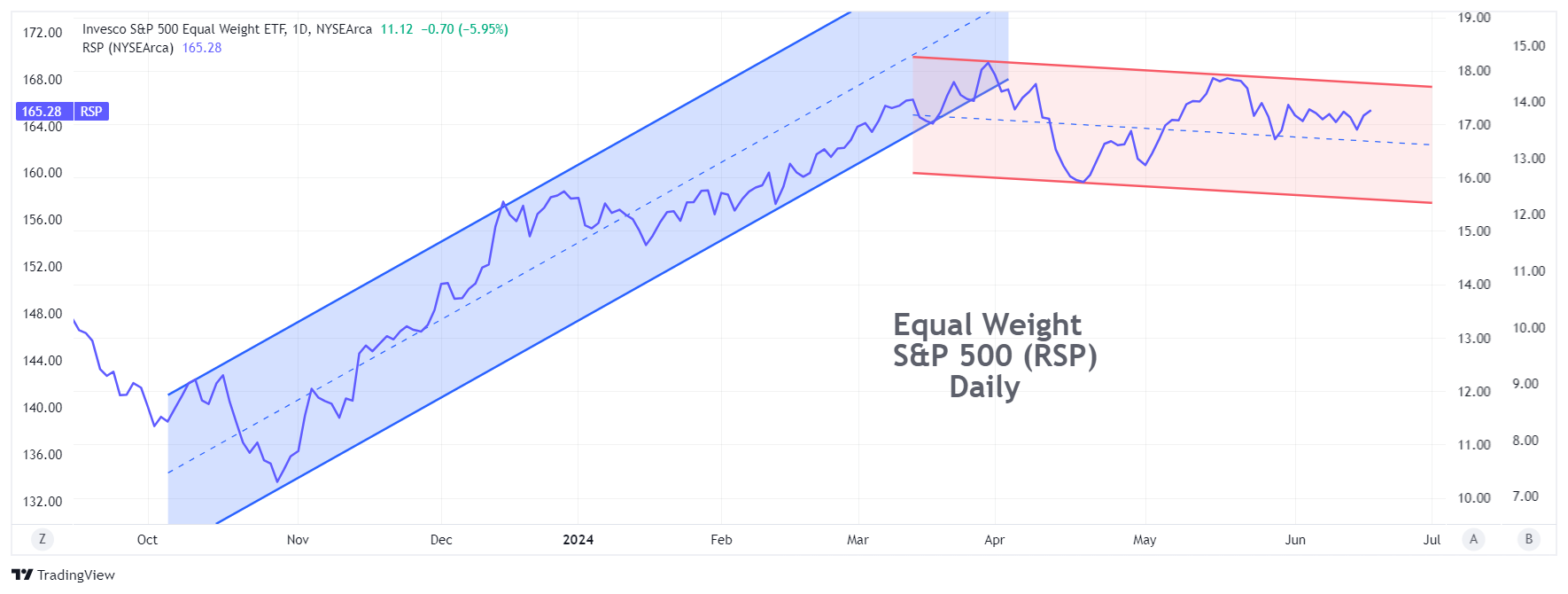

A similar chart of the S&P 500 Equal Weight ETF (RSP) tells a different story, as shown above. The RSP chart actually shows a declining trend since mid-March. This type of inconsistency or non-confirmation raises concerns among chart watchers regarding the strength of the trend.

While there are times when such a disparity is resolved by having the broader market 'catch up' to the leaders, that generally happens at the beginning of a rally, rather than at the end. Once a rally has been going for a while, such a non-confirmation tends to signal an underlying weakness that simply hasn't taken hold yet in the leading stocks.

Our strategy discussion for this week is about how to play such a scenario.

Strategy talk: When Broader Stocks Are Lagging

Naturally, any option strategy you select to play this scenario depends on which way you expect it to resolve. If you expect that the broader market will catch up and resume its uptrend, you could implement bullish strategies on the equal weight index. If you lean more toward the scenario that the uptrend in the cap-weighted index is peaking, then you could implement bearish strategies on either index.

One problem you will encounter is that there are not many choices for playing a broad-based equal weight index. Moreover, there is minimal option liquidity on any of them. Here are some choices:

- Invesco S&P 500 Equal Weight ETF (RSP); Some option liquidity on limited strikes, but only in the monthly expirations

- SPDR NYSE Technology ETF (XNTK); No option liquidity

- Invesco Russell 1000 Equal Weight ETF (EQAL); No option liquidity

- First Trust Dow 30 Equal Weight ETF (EDOW); No option liquidity

Another possibility is to use an inverse S&P ETF. You would implement bullish strategies on the inverse ETF, such as buying calls, call spreads, or covered call writes. Choices here include:

- Short S&P500 Broad Market (SH), which is 1x short the SPX index

- UltraShort S&P500 (SDS), which is 2x short the SPX index

- UltraPro Short S&P500 (SPXU), which is 3x short the SPX index

- Direxion Daily S&P 500 Bear (SPDN), which is 1x short the SPX

- Direxion Ultra Short S&P (SPXS), which is 3x short the SPX index

But here again, liquidity and option availability is minimal. In addition, the 2x and 3x ETFs use short-term derivatives to achieve their additional leverage and are designed for very short-term trading strategies, measured in days. Beyond a day or two, the double and triple inverse ETFs begin to lose their correlation with the underlying index. Option strategies are thus not advised here either.

Due to the liquidity constraints in their options, it is advisable to avoid the equal weight and short ETFs altogether and stick with the cap-weighted ETF (SPY), which has a high degree of liquidity in its options. With SPY, you can sell credit call spreads, buy debit put spreads, buy diagonal put spreads, buy put butterfly spreads, or combine these strategies, and implement them in almost any desired time frame with plenty of liquidity.

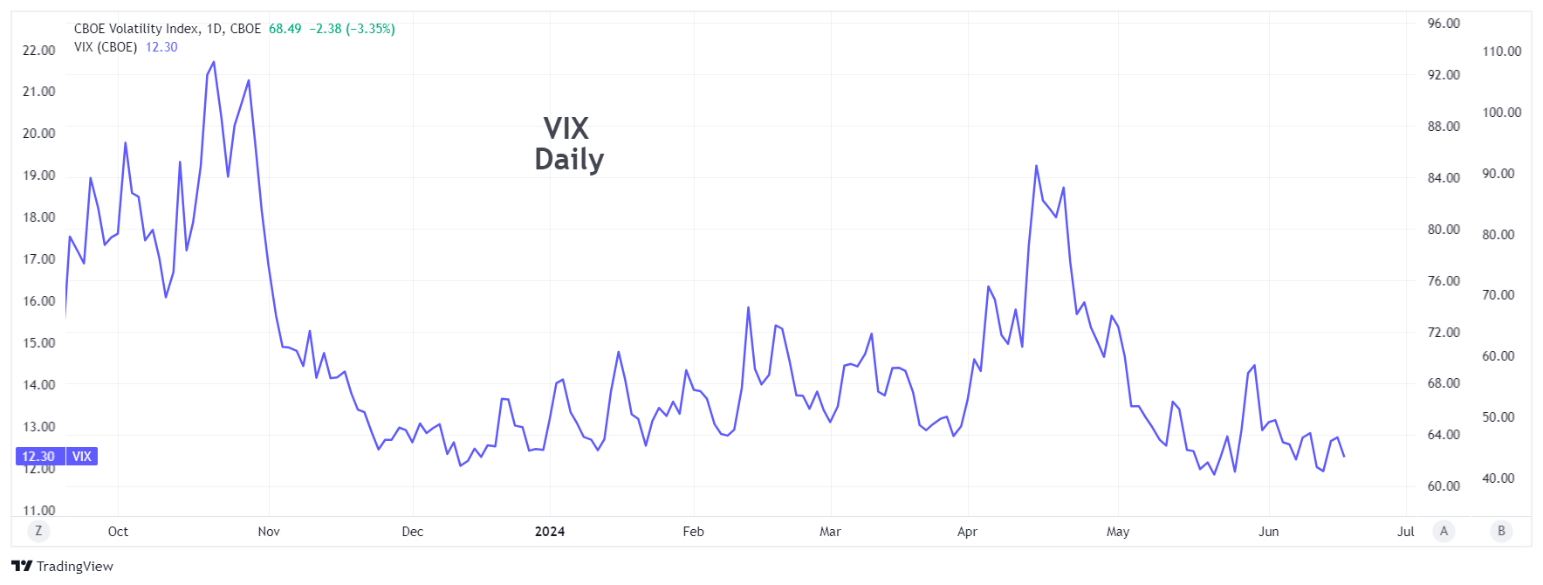

In addition, the purchase of VIX calls for a few months out remains another way to brace for a possible increase in overall market volatility, which would likely accompany a slide downward in the SPY index this summer.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.