Playing Bitcoin With Options

June 14, 2024

The Markets at a Glance

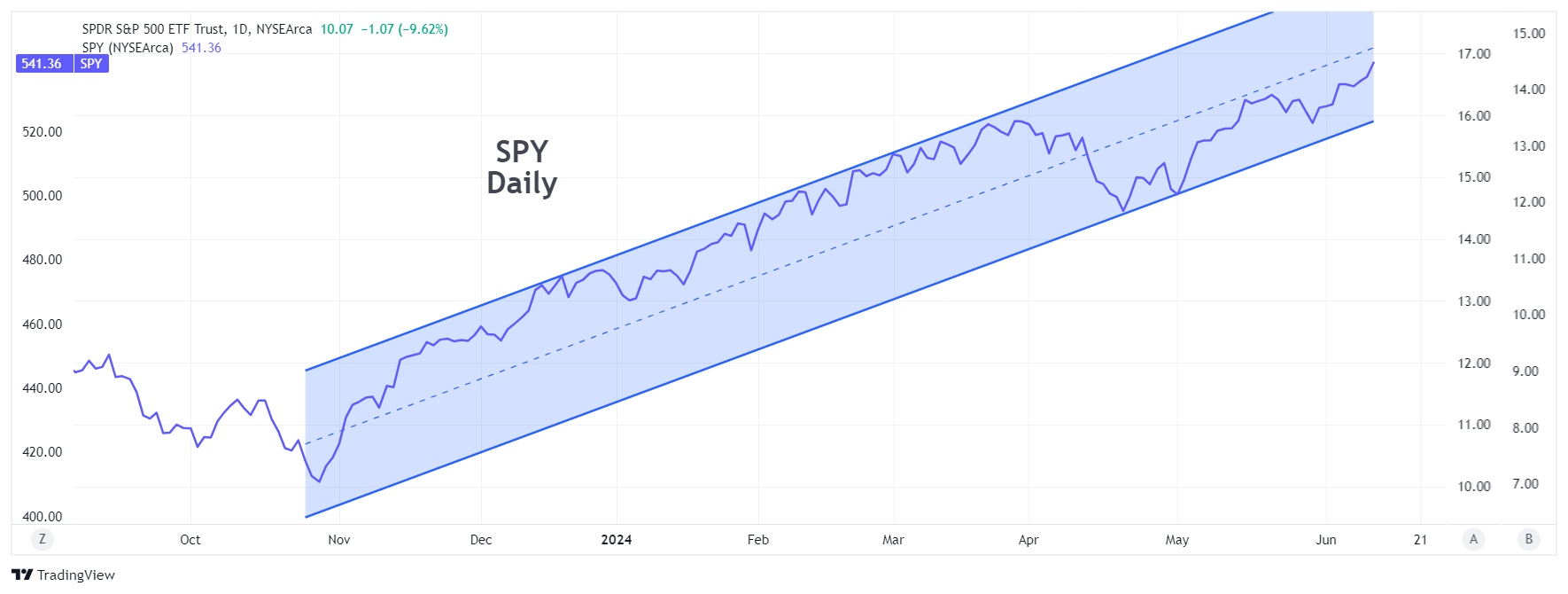

A positive reaction this week to cooling inflation coupled with a surprising increase in new job creation gave the bulls another reason to jump on the bandwagon and lift stocks to new highs once again. From a chart perspective, the suspicion that the current uptrend had moved to a lesser slope now looks more like an uptrend that is proceeding at the pace it began last October, having simply widened a bit in the April selloff.

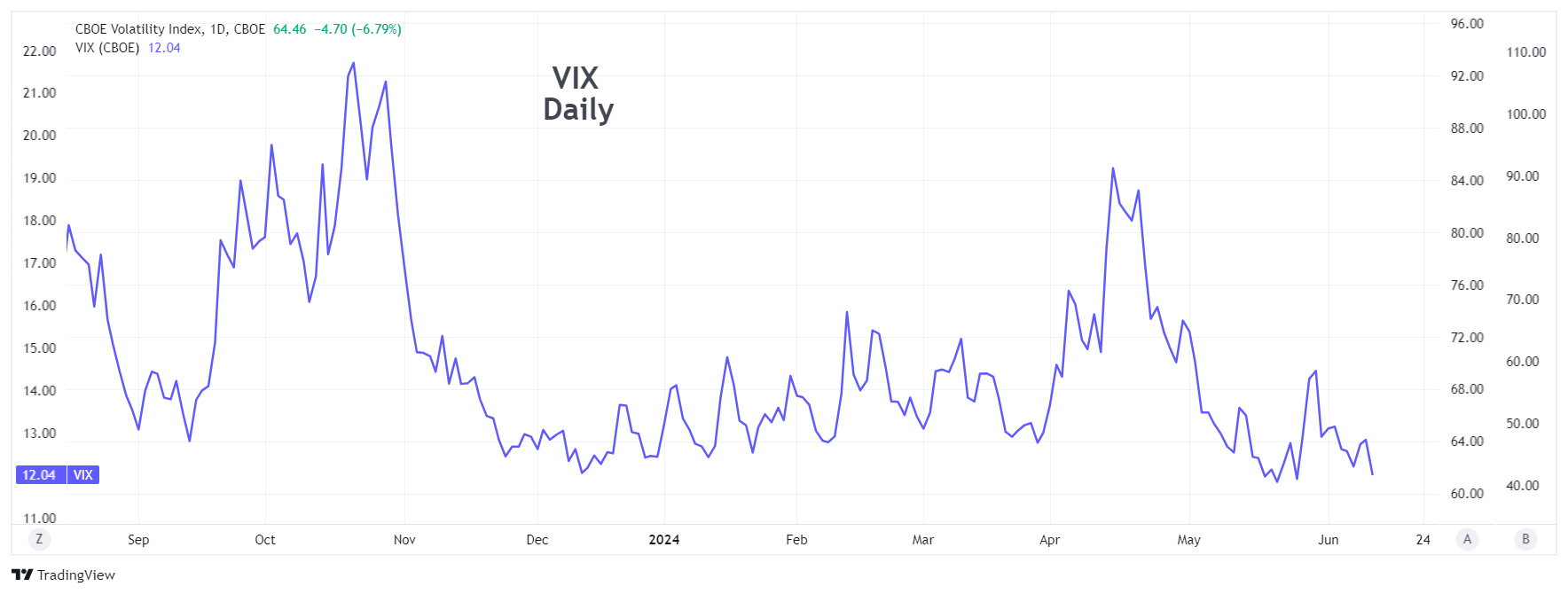

Either scenario has the uptrend now in its eighth month and continuing to set new highs. VIX accordingly fell back to 12, near its multiyear low once again. As investors view the combination of inflation coming under control, a healthy job market, and rate cuts potentially coming later in the year, they seem ready to accept that equity prices are still a good value, perhaps due to the optimism that AI will now start to bring productivity gains to corporate America.

As I mentioned last week, the low current readings in VIX continue to offer an opportunity to initiate long positions in VIX calls as a hedge against increased volatility in the S&P index later this year.

Strategy talk: Playing Bitcoin With Options

In January, the equity market got its first bitcoin ETFs, opening the long-awaited door for investors and institutions to acquire bitcoin through a regulated equity instrument that could be purchased in any brokerage account, even IRAs.

But there is yet to be listed option trading on any of the new bitcoin ETFs. That can be frustrating for traders who would like to hedge their long ETF positions, play the downside, leverage their holdings, or take advantage of all the juicy volatility inherent in bitcoin by selling options.

Unfortunately, option traders must still rely on bitcoin proxies to implement such strategies. None, however, represent a 'pure play' on bitcoin, and other problems exist.

The choices are as follows:

MicroStrategy, Inc. (MSTR) is (or perhaps we should say was) a software company led by a CEO (Michael Saylor) who is one of the world's biggest bitcoin bulls. Purchasing as much bitcoin as his company could afford (and issuing new stock or borrowing money just to buy more) Saylor has created a massive holding for MSTR in bitcoin, which accounted for $15 billion of the company's $22 billion in market cap as of the end of March.

In concept, that renders MSTR a bitcoin proxy and the stock does have options. However, option strategies on MSTR are problematic for several reasons:

• For starters, MSTR is over $1500 per share and highly volatile. The implied volatility of a 30-day ATM option is approximately 90%.

• Second, there is very poor liquidity in the options and substantial bid-ask spreads.

• Third, MSTR's bitcoin holdings are valued closer to $100,000 per bitcoin in the stock's capitalization, while less than $70,000 in the open market.

• And lastly, the bitcoin position is essentially controlled by a single person, who can do anything he wants with it at any time.

BITO is an ETF comprised entirely of bitcoin futures contracts - not the spot cryptocurrency itself. Futures prices do not necessarily have to correlate with the spot price and can be either above or below the spot price at different times. BITO also pays a monthly dividend, which reduces the intrinsic value of call options.

Most importantly, the futures contracts must be rolled as they approach expiration. If futures contracts being acquired are more expensive than the ones being closed (which is commonly the case), the roll ends up with fewer contracts going forward. This process can eat away at the underlying value of the ETF over time. For this reason, the ETF should be used only for short-term trading and not as the basis for options trading.

That leaves the bitcoin mining stocks as the only other way at present to trade listed options on a bitcoin-related instrument. Crypto mining stocks include:

Marathon Digital (MARA)

Riot Platforms (RIOT)

Hut 8 Mining (HUT)

Cleanspark (CLSK)

Valkyrie Bitcoin Miners ETF (WGMI)

Cipher Mining (CIFR)

Terawulf (WULF)

Hive Digital Technologies (HIVE)

Bitfarms (BITF)

All of these trade on the NASDAQ and have options, though liquidity can be an issue for some of the smaller ones. (A recent article on these can be found on the NASDAQ web site.) Since volatility can be high, I have found attractive covered call opportunities in stocks like RIOT and MARA, but it should be noted that once the bitcoin ETFs arrived, there is less interest by the public in using mining stocks as a bitcoin proxy and their individual business models have come under greater scrutiny. Also, the recent bitcoin 'halving' event means they now have to work twice as hard to mine the same number of bitcoins, putting pressure on their profitability, and in some cases their future viability as well.

Crypto miners generally hold sufficient inventory on bitcoin to be considered a bitcoin proxy, but they also have operations geared to mining cryptos which may or may not be profitable at times. They will tend to move in the same general direction as bitcoin but they should each be researched for their own merits. One thing to be alert to is the trend toward consolidation in the industry as bitcoin mining eventually winds down.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.