Buying Dips with Puts vs. Calls

March 27, 2025

The Markets at a Glance

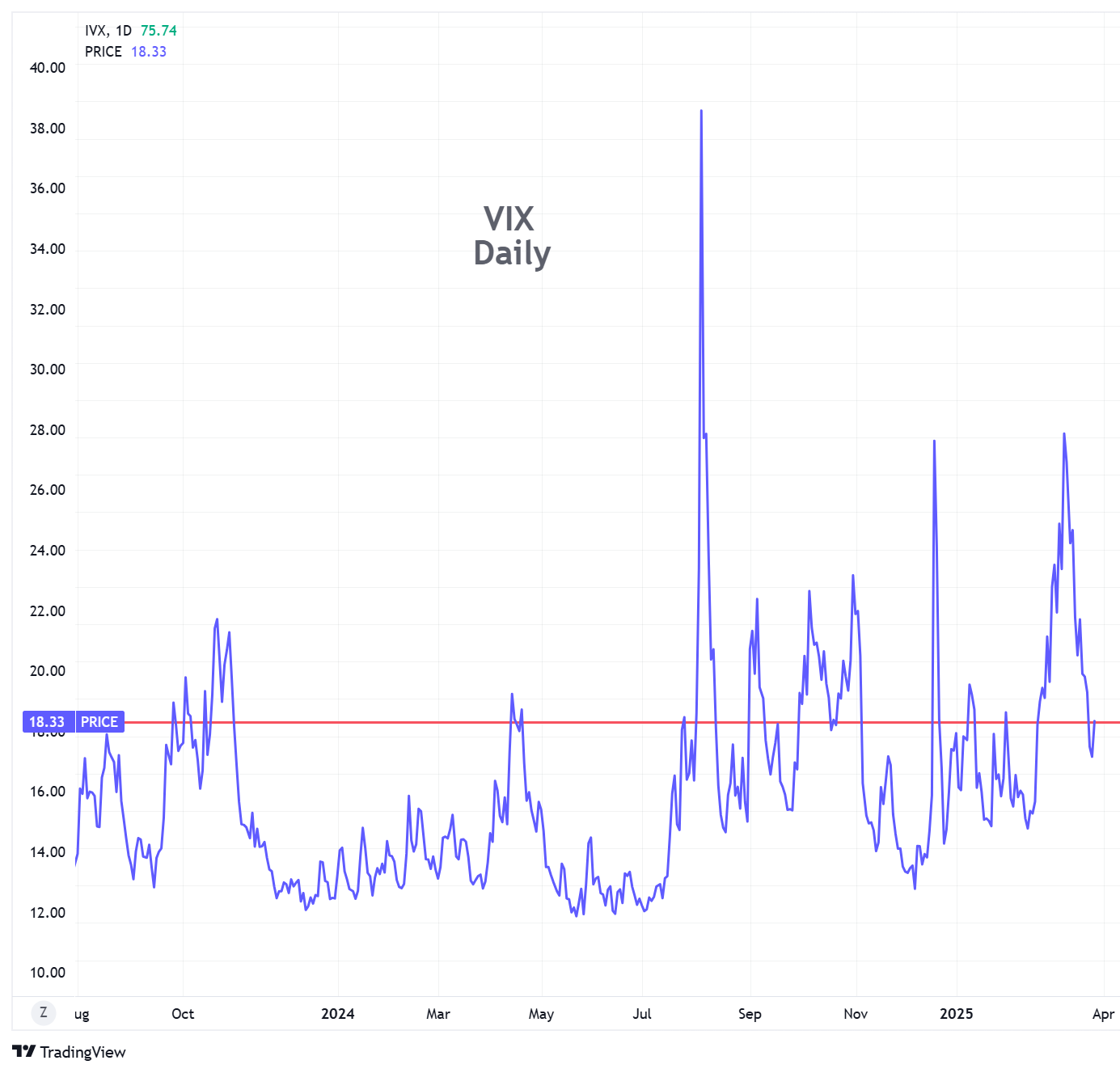

The market has rallied off the recent bottom in the last week and VIX has come sharply down from its peak near 29 to a level just above 18. Some people view a drop from a VIX spike as a bullish signal but I see it as more of a coincident indicator than a leading one. As soon as the market shows signs of bottoming, institutions will cash in their puts, thus driving the prices of all options down and lowering implied volatility.

Thus, a bounce in the market will be associated with a drop in implied volatility, but only as long as the bounce lasts. You can see from numerous past spikes in VIX that they often had sharp drops from their peaks only to spike up again within days.

That said, a bounce in SPY has definitely started and a drop of nearly 30% in VIX has occurred. This reprices options to considerably lower levels for SPY, though still higher than "normal", which many would consider to be down in the lower teens. A similar effect is playing out in individual stocks as well. Wednesday's drop in the major averages (SPY -1.2%, QQQ -1.8%, IWM -1.0%), however, is a wake-up call to those who assumed the market might shoot right back up to new highs.

The number of uncertainties surrounding tariffs, taxes, the budget, the debt ceiling, Social Security, Medicare and other policies will likely keep volatility elevated for some time and the fact that a recession is actually being uttered as a possibility will keep the audience from getting too overly bullish again just yet.

Younger investors wouldn't remember but there were periods in the equity market where prices rolled up and down for as long as several years with no material long-term trend.

Option strategies still favor writers here, though ITM call spreads might warrant consideration in some situations where a healthy rise is expected.

Strategy Talk: Dip-Buying Strategies

The urge to buy stocks or ETFs after significant sell-offs is one we are all familiar with and will periodically encounter with any security we choose. The urge is commonly heightened by looking at historic price charts which readily display all the prior situations where hindsight is now perfectly clear about when ideal buying opportunities existed. This unfortunately instills a false confidence about being able to pick exact bottoms as they occur.

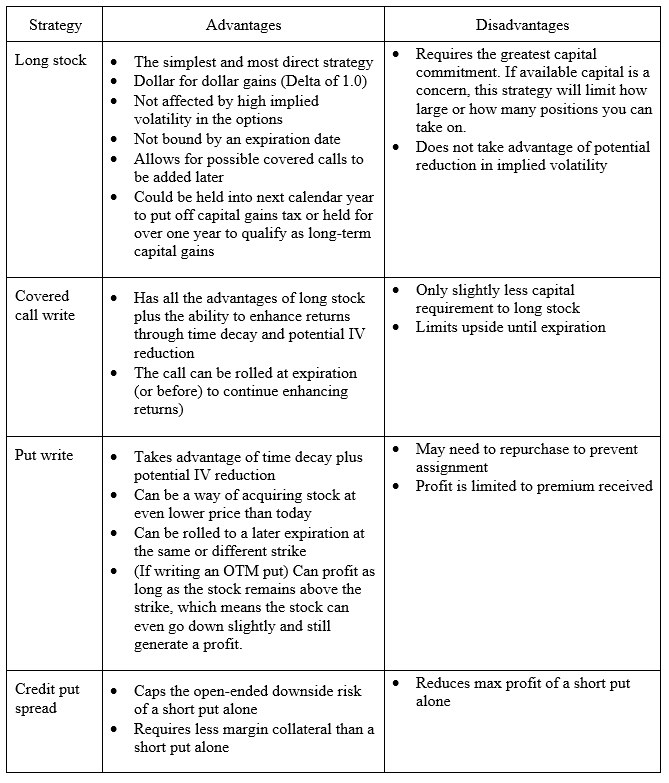

The directional actions an options trader can take when such an urge hits are essentially these:

- Buy long stock

- Buy long stock and sell a covered call

- Sell a put

- Buy a vertical or diagonal bull spread with calls

- Sell a bullish credit spread with puts

When a sell-off does occur, either in an individual stock or the market as a whole, it is inevitably going to be associated with a rise in implied volatility on the options for that security, and the deeper the sell-off, the greater the increase in IV. When IV is high, any spread strategy using long calls becomes much less attractive because the long side of the spread is now more expensive, so N4 above should be removed from consideration.

Let's examine the other alternatives.

Where does this leave you?

The first question I ask myself in these situations is whether I want to own the stock or fund I am considering. If I had liquidated or raised cash during the prior decline and I am looking to re-establish my portfolio, I will lean toward purchasing stocks. Otherwise, I will generally just look to write puts or do some short-term covered writes for a trade.

If I do purchase stocks, I will generally look to write calls as soon as possible – either immediately or the same day. I do that to give me further downside protection and to take advantage of the time and IV decay of calls in a declining market. While your upside is capped, it is capped at a level of return that should be rather attractive due to high-priced options and you can write OTM calls to give yourself even more upside potential on the stock. If the stock goes up, you can then reassess whether a good price bottom exists or whether more downside may follow and either allow yourself to be assigned, write another call after the first ones expire, or roll the calls you have to a further expiration.

The way I view it, I am picking up a stock at a relative bargain and then getting premium from the option while I see what the stock is going to do. There is no guarantee the stock won't continue down, but I will have at least some cushion on that by writing calls.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.