Put Spread Collars For a Short-Term Recovery

March 20, 2025

The Markets at a Glance

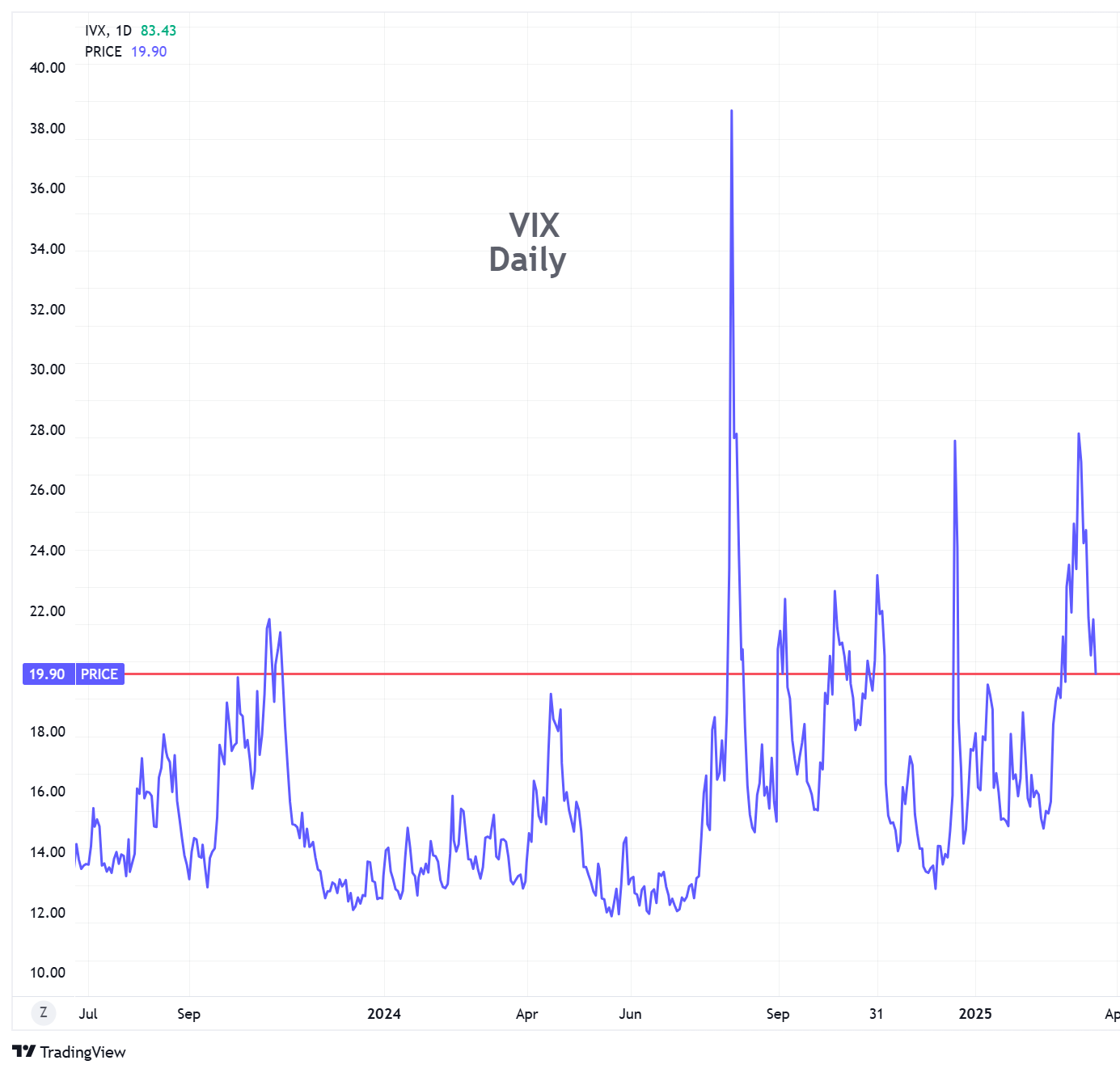

The market has begun to stabilize a bit and is up from its lows of last week. Expectedly, VIX has backed off as well, dropping to just below 20 on Wednesday.

Very little in the big economic picture has changed, however, from the previous week. And almost everything in the big geopolitical picture is where it was as well. In the short-term chart below, it appears that the steep downtrend of the last several weeks has turned upward. This leads to the big question of whether the recent decline has run its course (similar to the one in the Fall of 2023) or whether there is more weakness to come. It's important for traders to formulate an answer to that question in order to develop strategies here.

If you are looking at this as a one-time correction that has run its course, you would be looking to buy the recent dips here and picking up some perceived bargains either as long stock, covered call writes, or put writes. Long call spreads can be considered, but with volatility still near 20, the long side of a debit call spread (whether vertical or diagonal) will still be expensive here, making such spreads less attractive.

If you believe there is further volatility, uncertainty and downside risk here, you would be favoring writing strategies such as more conservative covered writes, put writes, and credit spreads.

I am in the latter camp right now, based on several factors:

- In the daily SPY chart, the lower boundary of the trend channel drawn off the October 23 lows was breached. This tells me the correction is not yet over and that we are merely in the first bounce now.

- The short-term decline to last week's low was swift and direct, with no significant attempts to buy dips along the way. Therefore, I see this bounce as the first attempt to do that and I interpret that not as an all clear to return to the long-term uptrend, but as merely the first expected bounce in a larger corrective downtrend.

Chart from the IVolLive Web

Chart from the IVolLive Web - Most importantly, the political uncertainties (wars in Ukraine and the Mid-East, trade wars, NATO disputes) and economic concerns (inflation, slower corporate growth, tariffs, possible recession, rates remaining somewhat high, etc.) show no signs of abating. In fact, one could make a case for a lot more uncertainty to come in the US, coupled with international tensions that rise even further as well.

So, my trading perspective at this time is to participate on a bit more of an upside move, but to do so with a hedge in place against further downside. My approach to that includes:

- Conservative covered call writes (writing short-term and using ATM rather than OTM calls)

- Writing puts or put credit spreads on stocks I am willing to own if they decline further

- Collars

Strategy Talk: Put Spread Collars

Like most option strategies, collars can be used or implemented in different ways. Simple collars are assumed to consist of long stock, a short call, and a long put, with the options in the same expiration. The premium received from the call roughly pays for the put.

A 'tight' collar (where the short call and long put are set to strike prices very close to where a stock is currently trading can be used to essentially "lock in" a price for a desired period of time. This makes it useful for tax strategies or for preserving capital with maximum certainty for a period of time.

A more aggressive collar can use OTM puts and calls, allowing for greater movement in the stock in either direction or it can allow for more upside or downside to suit a trader's specific expectations on the stock.

Collars can also be implemented with options from different expirations. A trader might purchase a longer-dated put while selling shorter-dated calls and then rolling the calls when they are set to expire.

A modification to the basic collar also allows a trader to adjust the downside protection of the position to make it more effective and potentially less expensive at the same time. The modification I refer to is the "put spread collar" – a strategy that has merit in situations where a specific amount of downside protection is desired or where put options are unusually expensive.

The put spread collar uses a bear put spread instead of a single put to protect the downside of the position. The spread offers several advantages over the long put by itself:

- It can tailor the downside protection to a range of prices on the underlying stock rather than protect from a given price all the way to zero, which a long put will do by definition.

- It saves money over the long put by itself (thus enhancing potential return as well).

- It can be designed to provide protection that starts sooner (i.e. at a higher price on the stock, should it fall in price).

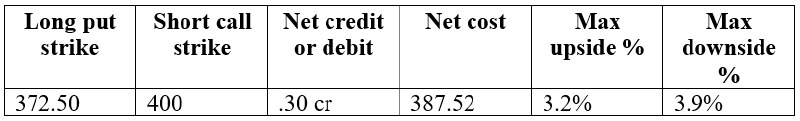

Let's take Microsoft (MSFT) as an example. The stock closed at 387.82 on Wednesday. That's still not very far from the recent low of 376.91, but it's down 15.8% from its last major peak at 447.48. If we take a short-term perspective, the April 4th expiration (16 days) offers the following typical collar scenario:

Using these strikes, you get a small net credit for the options and you have slightly more downside risk than upside opportunity. To allow for upside, you select the 400 strike for the call. That gives you approximately 3 points of premium. If you use that to purchase a put, you could buy the 372.50 put and still have a small credit. But your downside protection would not even begin until the stock dropped 15 points from its current level.

The 372.50 put would then protect you all the all the way down to zero. But is that really needed? Wouldn't you be much more concerned about the first 15 points of downside? After all, the stock was just recently trading at that level a few days ago.

I would argue that having downside protection from the current price of the stock to the recent low is more important than protection from the recent low to zero. Using that logic, why not purchase the first 15 points of downside protection instead of protection from the recent low down to zero? To do that, you would purchase a put spread instead of a long put by itself.

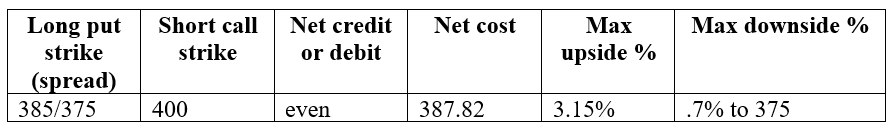

Using the 3 points you would get from the short call, you could purchase a 385/375 bear put spread for about the same cost as the original long 372.50 put by itself. That dramatically changes the risk-reward characteristics of your strategy. Here is the result.

You now have almost the same upside as before, but you only have .7% downside as long as the stock does not fall below 375. You will, however, now have additional downside from 375 if the stock falls further than that. So, to be clear, you are reintroducing downside risk below 375.

The question you need to ask yourself is what do you want to protect for the next 16 days – all prices below 372.50 or prices between 385 and 375?

The current scenario is that we've just had a 10% market decline with even more of a drop in certain stocks. If we are looking for some upside over the next couple of weeks as stocks stage a short-term recovery, and we believe that the recent lows will provide some support, we might argue that the risk/reward is now different from what it was when the market peaked in February.

And if that is true, then the put spread collar could represent a very attractive strategy.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.