Volatility Signals

March 13, 2025

The Markets at a Glance

Markets may not be predictable but the media often is. Now that the equity market is down about 10% from its prior peak (SPY closed at 8.9% below the Feb. peak on Wednesday but traded at 10% below during the day on Tuesday), media attention has been quick to point out that it is "almost a correction". In my view, such statements are nonsense and the term "correction" effectively meaningless. For one thing, it simply represents little more than the public's penchant for round numbers to represent key milestones. More importantly, it tends to imply that a 9.8% drop is nothing to be concerned about, while a 10% drop implies much more downside to come.

The media is also rife with analyses by numbers geeks who will compare this to all the other 10% corrections in past years or all other volatility spikes of current or greater magnitude in the past. These comparisons at least have a bit of statistical validity, but they offer no real insight into this particular decline and what's behind it.

I prefer to assess what is causing the selling behavior and how that might play out in the coming weeks and months. As I mentioned last week, it seems that a lot of people bought equities in the late Fall with the optimism that the Trump administration would be good for business (less regulation, fewer taxes, and protective tariffs against overseas competitors). That was all anticipatory. In reality, we now have less regulation, but the tax reductions are not here yet and the protective tariffs were met with stiff retaliation by our trading partners.

Inflation is holding for the moment, but the tariffs now in place are widely expected to add to inflation later this year, which will further stall any need to lower interest rates. In addition, some corporate earnings have slowed and the GDP for the first quarter is expected to fall by an estimated 2.8%.

So, the economic picture has, in fact changed, and has raised the possibility of a recession if things continue down this path. Investment firms are accordingly lowering their expectations for the year.

I therefore see this as a reality check from the blind optimism of the Fall. The increase in volatility comes from two factors: A rush by institutions to buy protective puts; and a reaction to the political chaos of the last two months, with major policy changes often coming, and later reversing, on the same day.

Where does this leave us?

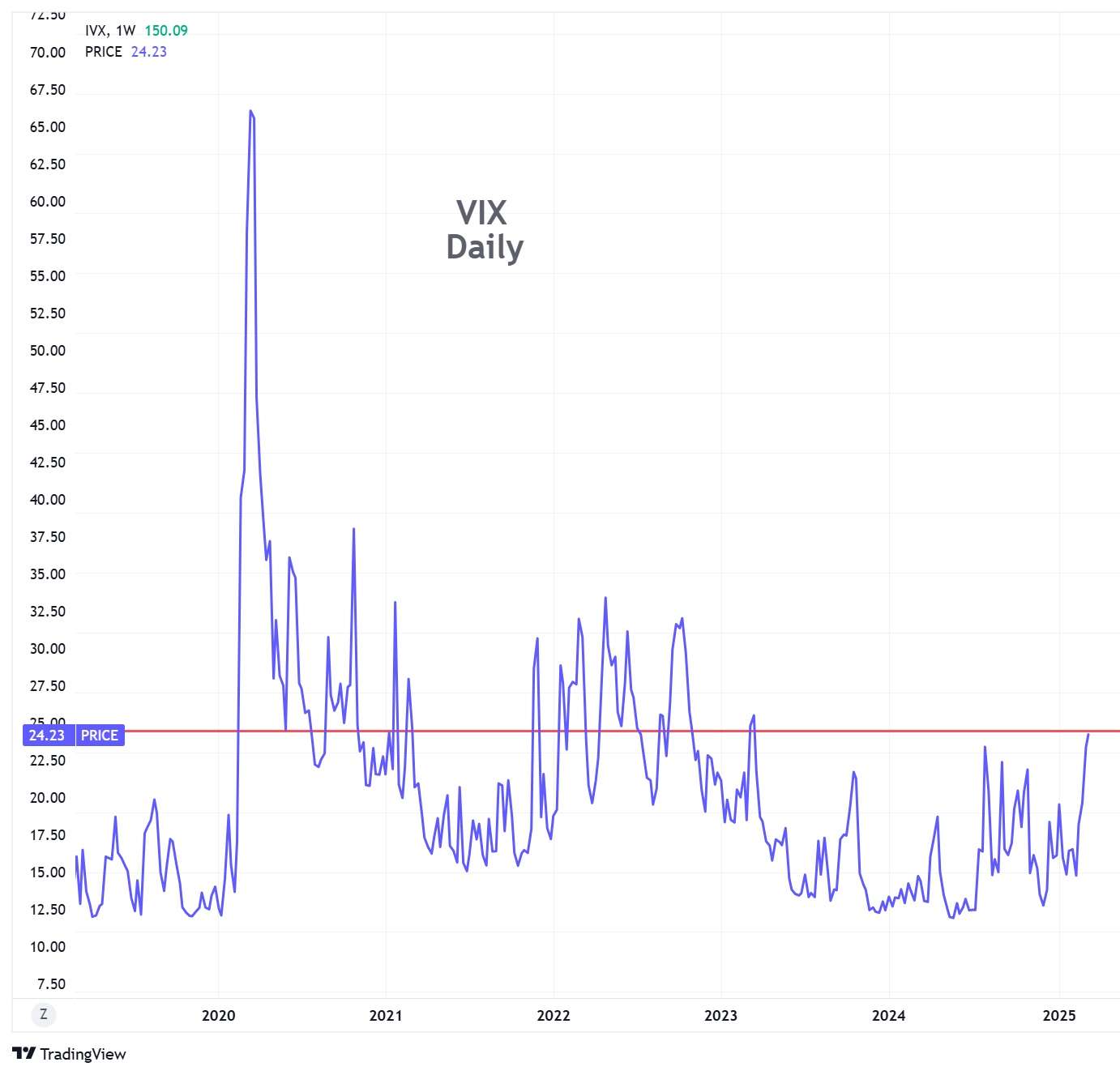

Volatility is unsustainable at this level, so as the market tries to establish some support, the spike in VIX will retreat. That could occur at any time now. The chart below is a chart of SPY showing the recent decline from the February peak. If SPY were to break upward from that steep, narrow down channel, it could have enough momentum to begin a recovery upleg.

I would not, however, expect a "V" formation here where the market recovers most or all of the decline in one quick upleg. That's primarily because I believe the price reset was justified by new economic conditions and they are not likely to reverse course so easily.

The fact that the quarter-end will bring a big negative GDP number and the fact that tariffs are in place and actually increasing is likely to keep the market at bay for a while. Other factors that could be a big damper include the government spending deadline on Friday. If that cannot pass, the markets will almost certainly back off again toward, or beyond, the recent lows.

As for volatility, it usually takes at least a week or two and sometimes many weeks to return to more 'normal' levels after a spike like the current one.

Strategy Talk: Premium versus Upside Appreciation

As long as volatility remains elevated, option writing will remain attractive, and at current levels, the returns from premium decay will offer a very good alternative to simply being long stocks or ETFs.

As a market begins to stage a rebound, call writers may think that it is better to let stocks run with no calls at all or to write OTM calls very far away from the current price to allow underlying equities to appreciate without the constraints of short calls on them. This is very optimistic and it satisfies the fear of regret that call writers can experience when their stocks rise above the strikes of the calls written. Regret is a powerful emotion.

It is, however, generally not the best strategy. If the market had staged a big one-day decline on news that could conceivably result in a huge and fast recovery, that strategy might be appropriate. But for a market that has been whipsawed by a barrage of negative news and is likely going to regain its footing the same way, I would continue to write calls in order to capture the reduction in volatility in addition to the appreciation in the stock. It helps to remember that a call writer doesn't give up any upside from a covered call write unless the stock exceeds the strike price at expiration by an amount greater than the premium received for that call. When premiums are as high as they are now, the likelihood of stocks doing that are much reduced.

Furthermore, if a call writer is assigned or has to roll positions further out, he has made a profit and likely a good one. If the stockholder chooses not to write calls in the hopes of a rebound, he is betting on being absolutely right about near-term gains and is still holding a risky position.

With overall implied volatility very high and individual stock volatilities much higher still, traders will often be much better served through continued writing. The rationale is as follows:

- Writing calls as stocks are recovering from a steep decline takes advantage of both the gains in the stock and the drop in implied volatility of the calls.

- The premium received is essentially a fixed return that compensates the writer for all stock prices beyond the strike price. If your stock is say 95 and you can get 2 points for a 7-day call at the 100 strike, you still have 5 points of potential upside in addition to 2 more points which are guaranteed. The call writer therefore does better than a stockowner with no calls written for all prices up to 102.

- If you write a call like the one above and the stock is above 102 at expiration, you will have done very well and can then likely get an excellent roll to an even higher strike for the following week and take in more credit besides.

- Traders will often overestimate how quickly a stock price will recover and will forget to consider that down days are still likely to occur.

Instead of lamenting that a stock went up through the strike price on a covered call, traders should celebrate how much they made back on it and, if volatility is still high, how much more they can potentially make when rolling forward. Even when staging a recovery, stocks will rarely just explode back up in straight-up fashion. When the zig-zags occur, the writer will be happy to have the premium from the call write.

Traders shouldn't look a gift horse in the mouth when being offered exceptionally high premiums for calls on their stock. High implied volatility is not generally caused by a high demand for calls – but rather a high demand for puts. The arbitrage then prices calls higher as well. Essentially that's a gift to a call writer. If the stock goes above the strike at expiration, that will be a good problem to have!

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.