Agency MBS Market: A Highly Liquid but Inefficient Market

March 12, 2025

In inefficient markets, bonds trade at "wrong" prices for an extended period before adjusting. Market inefficiency is typically the result of illiquidity. For example, in the municipal bond market, less than 0.5% of bonds trade annually, making it unclear where these bonds should be priced.

The MBS market, however, tells a different story. The average daily trading volume for agency MBS was approximately $370.3 billion as of February 2025. Extrapolating this daily volume over 252 trading days results in an estimated annual trading volume of around $93.3 trillion. This suggests that the annual trading volume is approximately 7.8 times the total outstanding MBS volume, underscoring the market's high liquidity and turnover.

So why do MBS bond prices remain inefficient despite this liquidity?

We believe the reason is similar to why U.S. hospitals can charge vastly different prices for the same services – sometimes with price differences of up to ten times. The core issue is transparency. However, in the case of MBS, it is not the transparency of prices but rather the transparency of the data backing these bonds:

- Some data is available (e.g., for agency loans), but it is highly complex to use. Instead of analyzing this data directly, most market participants rely on "black box" models that produce contradictory results.

- Some data is not publicly available at all (e.g., for non-agency 144A deals).

We believe that if market participants could use this data directly to price bonds, it would improve pricing efficiency in the MBS market. This, in turn, would lead to lower borrowing rates for consumers and benefit the U.S. economy overall.

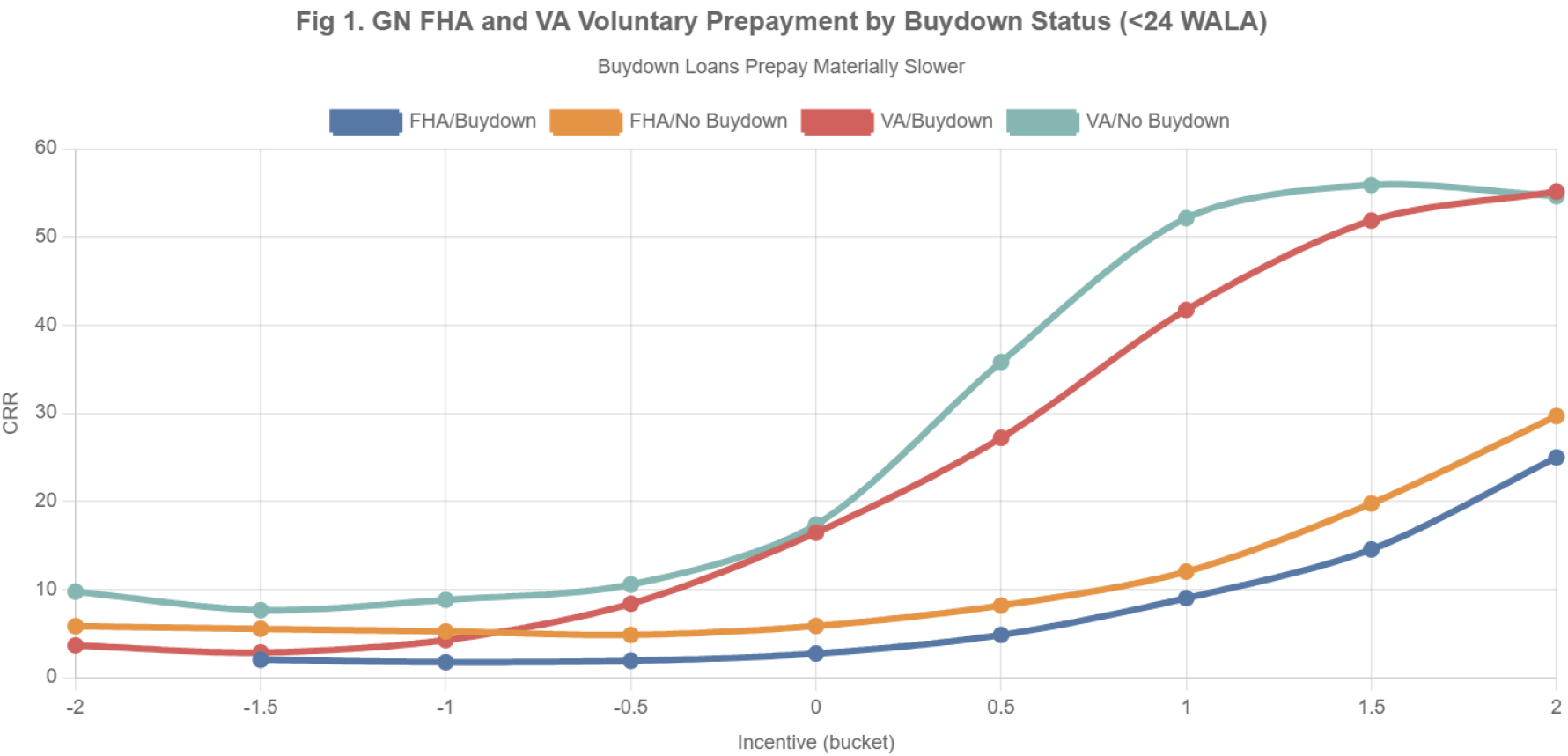

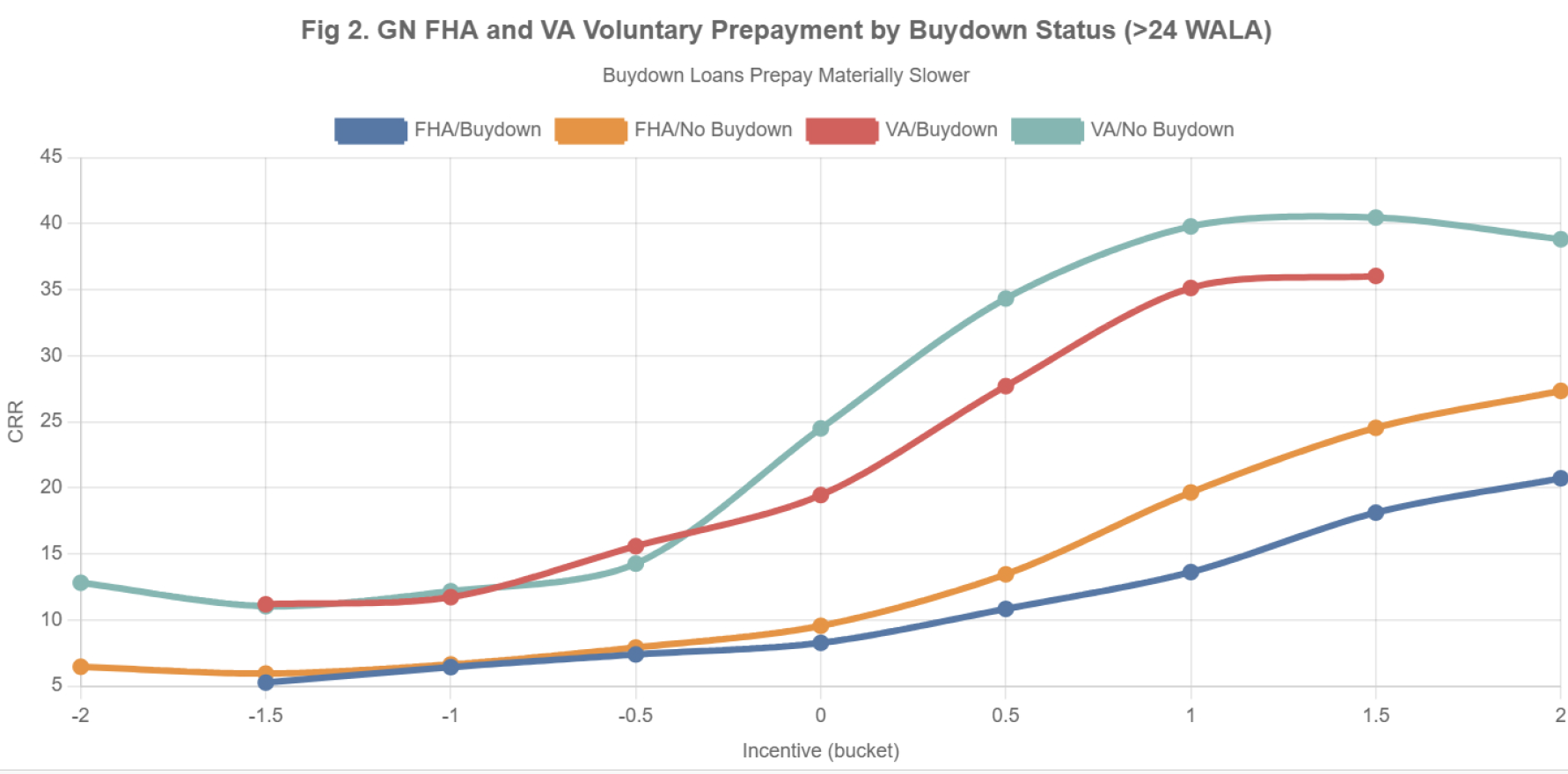

Our objective is to provide and market data-driven tools that facilitate mortgage valuation using direct data access while identifying all fields that are material to MBS bond valuation. For example, the analysis of Loan Buydown, a lesser-known but material factor in MBS bond valuations – often mispriced by the market – is illustrated in the figures below.

A mortgage Loan Buydown is a financing arrangement where a borrower or a third party (such as a home seller, builder, or lender) makes an upfront payment to reduce the mortgage interest rate for a specific period or for the life of the loan. This effectively lowers the borrower's monthly mortgage payments.

- Fig 1: GN FHA and VA Voluntary Prepayment by Buydown Status (<24 WALA)

- Fig 2: GN FHA and VA Voluntary Prepayment by Buydown Status (>24 WALA)

If you would like us to run custom valuation reports on your bonds, please let us know!

Free Trial

The data and analytics used in the figures below can be accessed by requesting a free trial HERE.

Why Choose Us?

With over 20 years of experience and a proven track record in data and analytics development, IVolatility serves more than 500 institutional clients and 130,000 retail customers. Now, we're bringing this expertise to MBS data and analytics. Discover the benefits of using IVolatility solutions for MBS HERE.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the MBS data insights discussed in this post. If there is something you would like us to address, we're always open to your suggestions. Please let us know!

Previous issues are located under the News tab on our website.