Up on Optimism - Down on Reality

March 6, 2025

The Markets at a Glance

I am old enough to remember watching the markets on October 19, 1987. It was like standing on a ski slope and witnessing an avalanche. We knew that what we were witnessing was historic in proportion but we felt helpless against the overwhelming power of things well beyond our control. We become paralyzed to take action because what we were witnessing was so far from the normalcy we were accustomed to that we could not process it with traditional thinking.

I am not saying that we are having another 1987 or that a crash is imminent. I am saying that the markets are behaving outside their normal patterns and that we have to adjust our thinking accordingly – in some cases learning as we go. We have had markets that sell off like this many times before, but we have never in recent times had so much polarization or upheaval in national government, business, or on the global stage. And we do not really know where all this will lead just yet but we do know we will have it for quite a while.

So far, the downward move in the markets registers simply as a minor sell-off within the long-term trend. It hasn't even breached the 10% level that pundits label a "correction". I took a longer view in the charts for this perspective. That should not be construed to mean that a bottom is in and we are heading back up to the highs again soon.

I believe the market is selling off the excess optimism of the Trump election, especially as the reality of tariffs and other policies takes hold. Even Trump admitted that the tariffs will cause some near-term pain in the form of higher prices. Furthermore, they are inflationary, so they will likely put off any interest rate reductions for a while. In my opinion, if the markets are going to deal with the reality of tariff pain and continuing high interest rates, they will not likely return to the highs anytime soon.

It doesn't necessarily mean that we are going to have a major (i.e. >10%) correction, though that probability is far greater now than it has been for months, since we are not far from that level. Any disappointments from trade wars or other fronts will likely keep the market under pressure.

What is particularly disturbing to me is the internal volatility, which is way outside normal parameters. And given the current administration's penchant for drastic and impetuous changes, reversals of those changes, and talk about changes that may or may not even happen, I expect we are in for a lot more volatility ahead. This isn't just me saying this – it's the market telling us this.

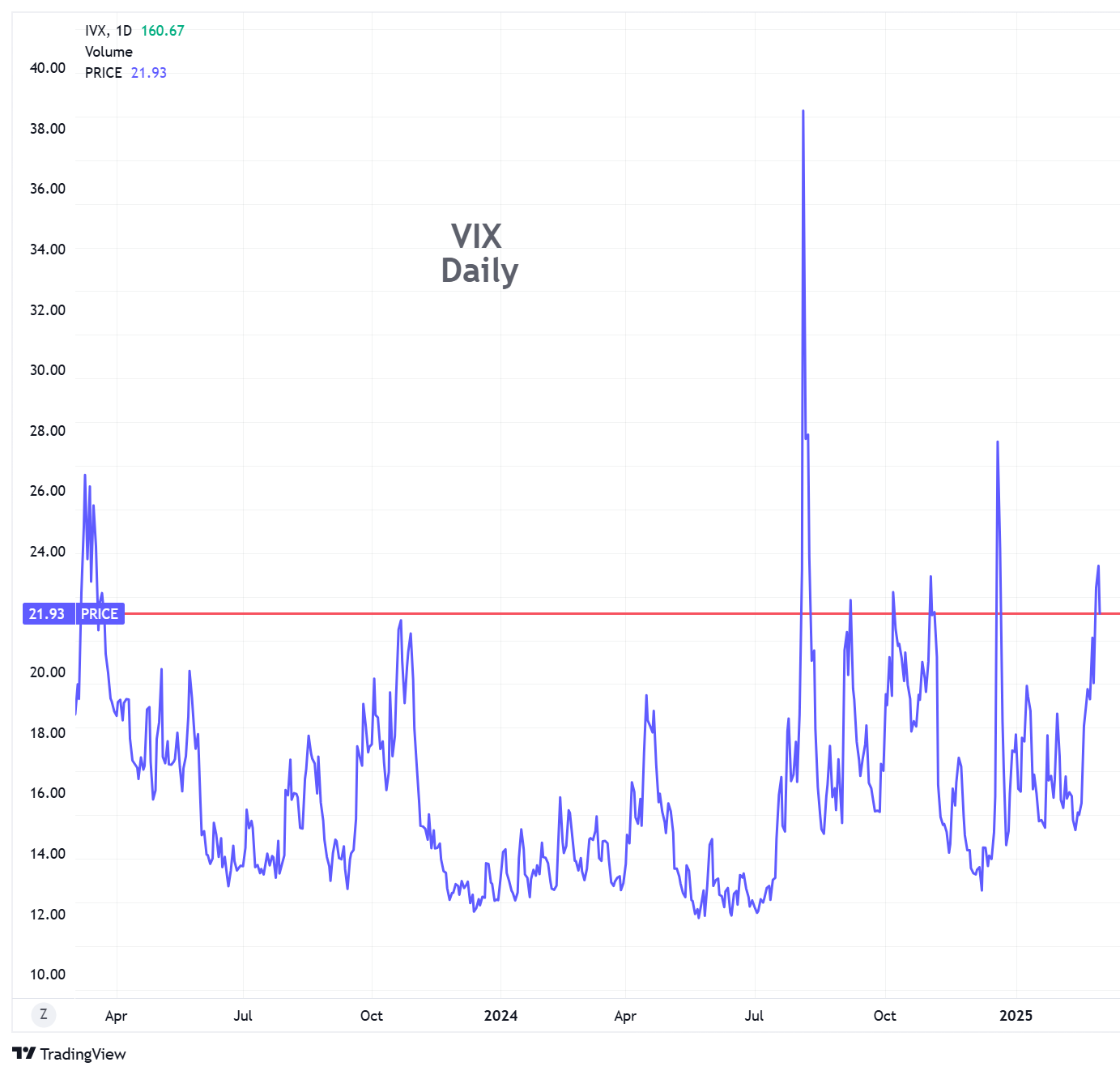

VIX is well above 20 now and has only been higher 3 times in the last two years. But it is not the most worrisome aspect of current markets. It's the intraday volatility. Below is an intraday chart of SPY on Monday and Tuesday of this week and indicated on the chart are the intraday moves in points. Bear in mind that a move of just under 6 points is one percent.

There were four moves in two days over 1%. In fact, they were roughly 1.5%, 2%, 2.5%, and 4% in alternating directions. For perspective, a long-term average move for a full month is around .6%. Over the last week, we have been having moves of that magnitude in minutes!

Volatility can certainly be useful to options traders. But this is not daily volatility – it is intraday volatility, and it can be quite hazardous to those who don't expect it or who are not watching the markets for possible reversals.

Strategy Talk: Premium, Premium, Premium

Option writers love premium. Buyers, of course, do not. With a very high VIX and with intraday volatility even higher, there is a lot of premium sloshing around out there. It is likely to be with us for a while.

I spoke about this last week as well, but it's too important not to address it further. This much volatility is a very unusual situation and a lot of option players (myself included) need to adjust their strategies and their thinking to play it effectively. So here are some additional thoughts and tips on strategies for current markets.

- Premiums are sky high but there is a reason. They are very tempting for sure and writing can be a lucrative strategy here but keep your perspective. Premiums are high because recent activity substantiates higher premiums. It may seem like a gift, but you need to take into account that underlying securities are moving a lot more than usual. The norms you have in your mind from experience may not match with current realities. Writing credit spreads will seem attractive but you'll need to watch them and some may surprise you. Covered calls are safer, especially when you are ok losing the stock if assigned.

- There is generally a skew over the short term toward higher IVs with the market generally assuming volatilities will return to normal in a month or so. Check your target stock for the skew to know how IVs are subsiding over longer durations. This will favor diagonal call spreads where your long call is a month or two out and your short is close in.

- If doing short-term covered call writes, you may be tempted to write OTM calls hoping to capture a nice move in the stock plus a healthy premium to boot. That may work for you sometimes, but remember that volatility works in both directions. A lower strike offers less potential upside but has greater protection. I have found that even if the stock moves higher and the short call does become ITM, you can roll it for a credit or roll up in strike price to keep the position going.

- Many options are holding time premium right up to, and even beyond, the close of trading. I saw expiring SPY calls that were a full point OTM (SPY was closing near 593 and the expiring 593 calls still traded near 1 point with less than a minute before the close). That could be because there were so many people wanting to buy them back or because the futures were running, but the market makers can see all that and force people to pay up to close or roll those short calls. These days, order imbalances could easily move SPY more than a point in the closing seconds of trading or shortly afterward. If you are rolling a spread or covered call write, you could have little choice but to pay up to close an option that could essentially be worthless.

- Because options are holding premium longer, butterfly spreads and vertical spreads are less attractive because you may have to pay more than you want to close the short legs.

- Short puts or quick covered writes (even on zero day options) can offer possibilities to grab premium, especially if you are okay being assigned and not forced to buy back the short options before the close.

- Adjust your thinking about how far you believe a stock or ETF might go. Assuming 2X standard moves may be more in the ballpark right now.

- Put in orders early when you can. With this much movement, you can target a price when opening or closing and get an order in early in the day. You may be surprised to get your price as things move around during the day.

- Good luck! Try not to get whipsawed and you should do well in this type of market.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.