An Abrupt U-Turn

February 27, 2025

The Markets at a Glance

The slight new highs achieved last week led to a rather sharp U-turn this week as the equity market sells off and implied volatility spikes upward. In the bigger picture, the uptrend from 2024 remains intact but since the election high in early December, the market has essentially gone sideways with several big swings in between. And SPY is only around 2.5% below the recent high, so it is premature to declare this anything more than a correction within the trend.

I do, however, believe it is not over just yet and that the sentiment in the market has changed quite a bit from the celebratory mood in December to a much more somber mood today.

Some of that can be attributed to the economy, earnings, and inflation, which are still relatively healthy but raising some serious doubts about being able to stay healthy throughout this year. With inflation not yet backing down and new tariffs expected to apply further upward price pressure, the expectation of lower interest rates has faded. One could even argue that given the somewhat firm stance on tariffs lately that the Fed might conceivably by forced to consider raising rates again this year rather than lowering.

The other major factor is the chaos caused by the new administration with regard to so many industrial sectors. While some stand to benefit from new policies, a number of others may be hurt by them and since they are all so new, it is difficult to project whether they will lift the market this year or bring it down. At the very least, the rapid changes being implemented are causing uncertainty, and that we know is something the market is not fond of.

On top of all that, there is seasonal weakness at this time that is falling right in line with the chart I displayed a couple of weeks ago. The pattern that showed up over quite a few years was a peak in mid-February, heading lower into March.

There are other factors at work here also. The AI bubble is losing a bit of steam, as is bitcoin, and geopolitics have been upended over tariffs and discussions on the Ukraine war.

My sense of all this is that it is a correction that was bound to happen, given that the fall rally was based on anticipation, both for lower interest rates, and for a new pro-business administration. Given that the inflation is not backing down as expected and that the administration is willing to throw some industries under the bus to serve their agenda, this seems like a case of the market now digesting the fall feast and realizing it ate a little too much.

So, what does that do to option strategies here?

Strategy Talk: Option Strategies for a Rapidly Swaying Market

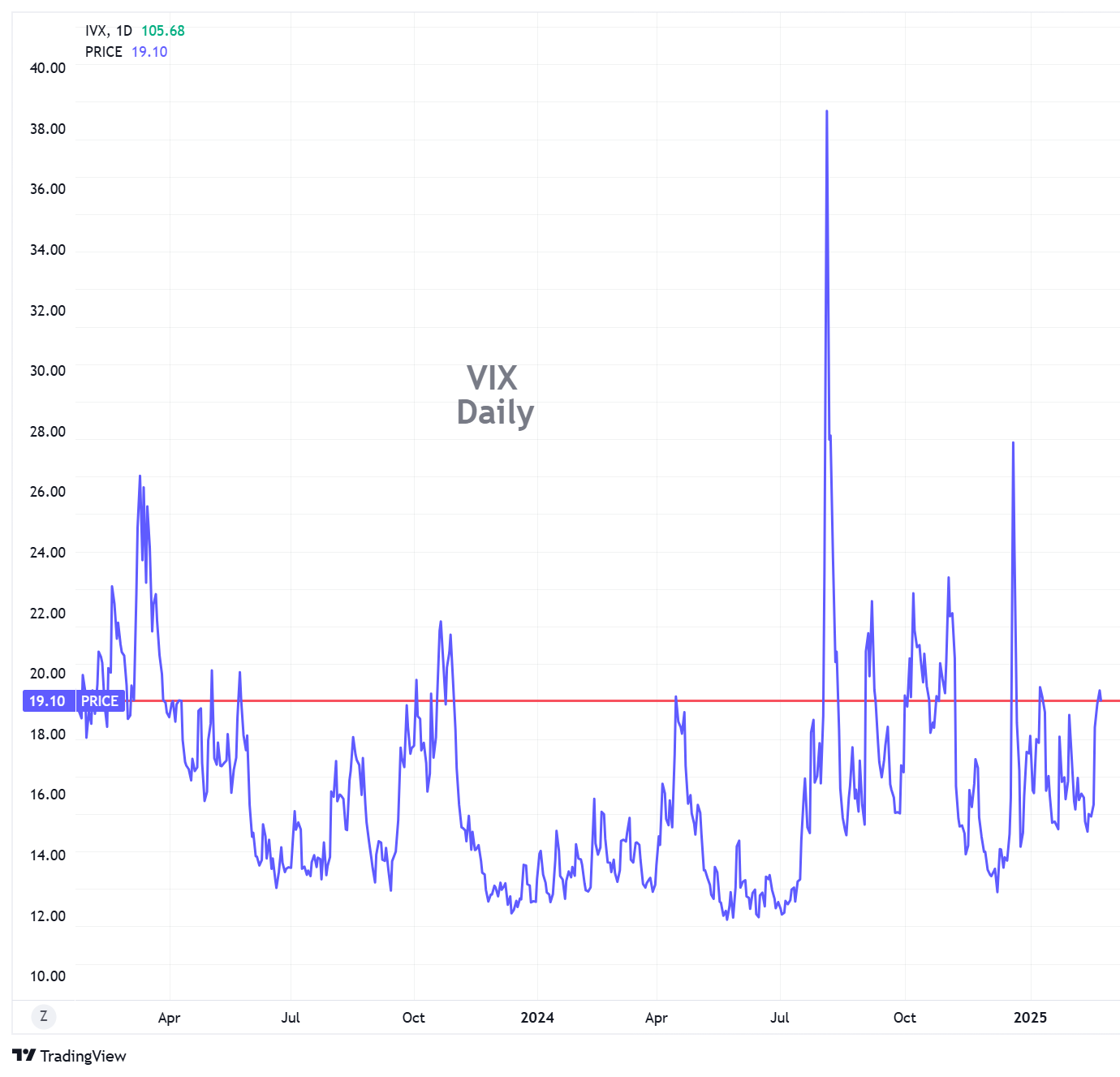

The first thing to note for option players right now is the spike in VIX, which also accompanies another new high for the SKEW index as well. This tells us that options are pricey right now on the market as a whole and that OTM strikes are even more so. That means options on many individual stocks are even more pricey.

From a strategy perspective here are some thoughts:

- If you are planning to trade some of the dips or peaks using long options, you want to consider using ITM strikes or simply buying shares and then writing covered calls.

- You might also look at selling puts to play the dips. I sold some puts today on NVDA for Friday. I got 2.5 for Friday's 120 puts. (That represented about 160% implied volatility). The logic was that if I had to own NVDA at the equivalent of 117.5 on Friday, I wouldn't be too upset.

- With VIX near 20, options on SPY are high again. And with daily moves on the SPY hitting 1% in an hour or two, you can find rather rich call options on SPY. I had purchased SPY shares for a one or two-day trade on Tuesday and wrote the Wednesday 595 call. After getting up to 599 early in the day Wednesday, SPY sold back down to 593 and was around 594-595 in the final minutes before the close. Because of the big intraday swings in SPY shares, the 595 call was holding a full point of premium even as the market closed with SPY slightly below the strike (trading at around 594.70). In other words, the 595 calls were closing out-of-the-money and still carried a dollar of premium! I could roll to Thursday for a credit but instead, decided to do nothing and to see if they would be assigned or not, (and I was in fact assigned). The lesson here is that in fast markets as we have been experiencing, options are holding a great deal of premium right up to the close. That makes for attractive zero day or one-day covered call writes but also forces you to pay up to close one if you want to roll it or prevent an assignment.

- Long butterfly spreads are also not attractive as they, too, will hold premium until the very end of the day they expire.

- If you have long VIX calls, a spike near 20 should give you a reasonable place to take a profit.

- If you are a buy-the-dip player in bitcoin, keep an eye on IBIT to write puts or do covered calls. The 2/28 options have an IV of 70% or more (dropping to mid-50% for the next week.)

- Resist the temptation to buy long options right now.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.