Reasons for the Increase in Ginnie Mae FHA Delinquencies

February 5, 2025

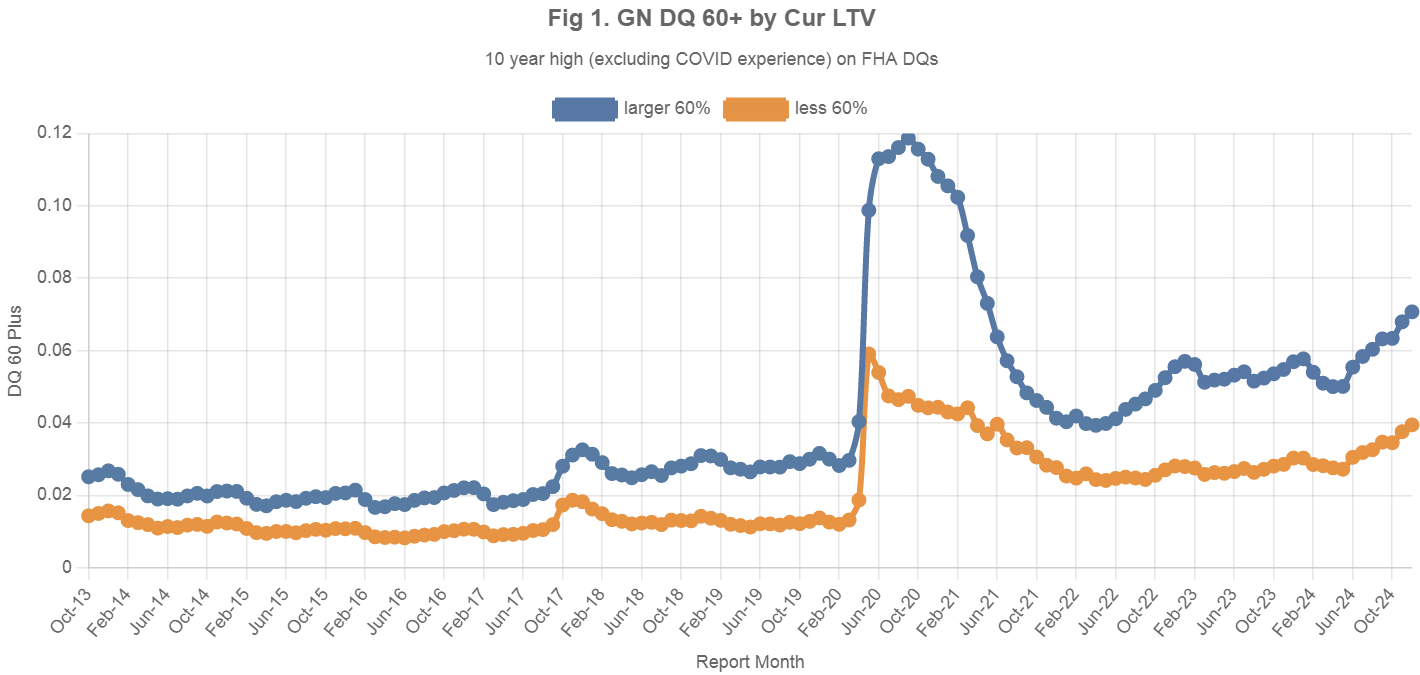

Delinquencies in Ginnie Mae FHA collateral have continued to rise, reaching the highest levels outside of the COVID period (see Fig. 1 below). We believe there are two primary reasons for this trend: one related to borrowers and the other to lenders.

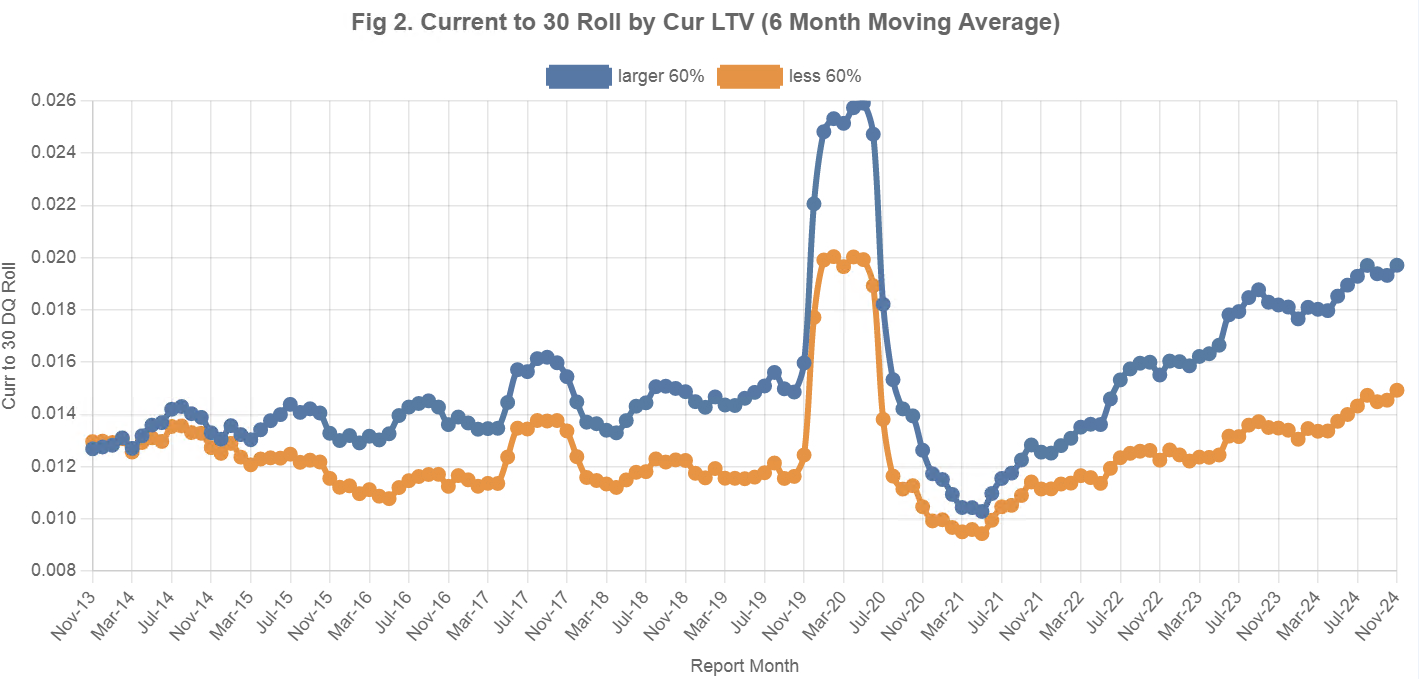

On the borrower side, lower-income, highly leveraged FHA borrowers are finding it difficult to refinance due to higher debt service costs at current elevated mortgage rates, increasingly rolling to delinquencies (see Fig. 2 below). In contrast, FHA delinquencies are significantly lower among borrowers with stronger credit profiles and lower current loan-to-value (Cur LTV) ratios, as these borrowers can more easily access home equity.

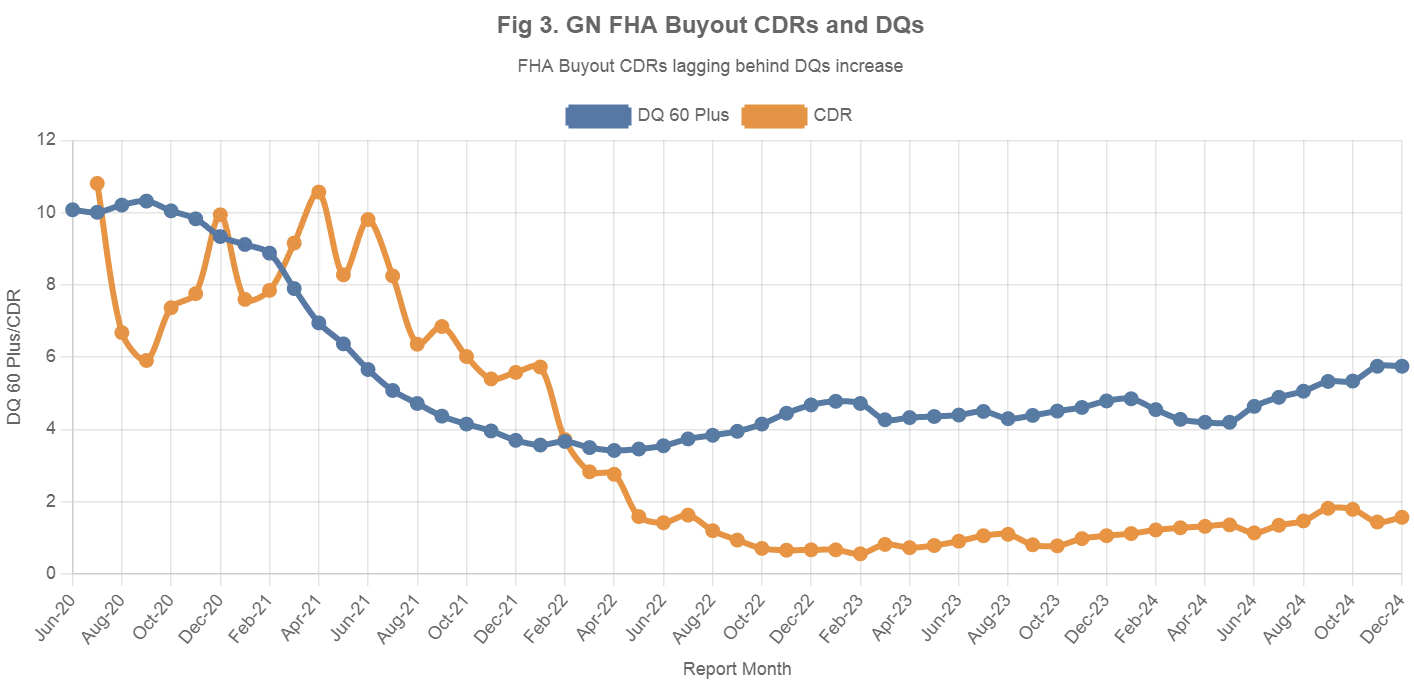

On the servicer side, buyout rates (CDRs) are lagging behind the rise in delinquencies. This is due to the prohibitively high capital funding rates for buyout pools, which create a negative economic incentive for servicers to conduct buyouts (see Fig. 3). As a result, we expect buyouts to remain low in the short term.

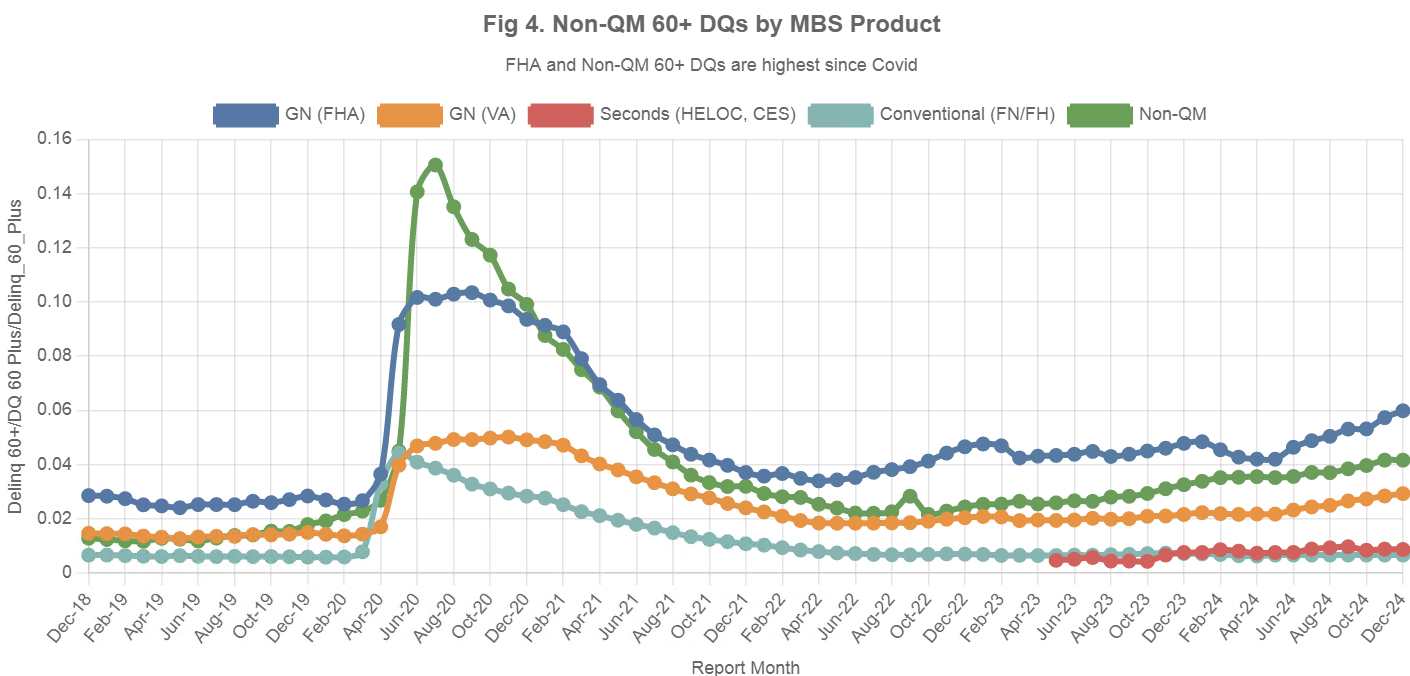

It is worth noting that delinquencies in FHA collateral are the highest among all major collateral types in both agency and non-agency sectors (see Fig. 4). This is due to FHA's weaker credit characteristics and higher Cur LTV ratios.

We find that the continued increase in delinquencies could be positive for investors in the discount and negative for premium bonds, as servicers must adhere to standard delinquency rate thresholds. This is likely to lead to an increase in involuntary CDRs over the longer term.

Free Trial

The data and analytics used in the figures below can be accessed by requesting a free trial HERE.

Why Choose Us?

With over 20 years of experience and a proven track record in data and analytics development, IVolatility has served more than 500 institutional clients and 130,000 retail customers. Now, we're bringing this expertise to MBS data and analytics. Discover the benefits of using IVolatility solutions for MBS HERE.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the MBS data insights discussed in this post. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.