Prepayments Are Not Extinct but Dormant

January 14, 2025

Primary mortgage rates at 7% are currently at local highs. Does this mean that mortgage prepayment risk has disappeared? The data suggests otherwise – prepayments are not extinct but merely dormant. In fact, if mortgage rates decrease, prepayments are likely to exceed the highs observed in the past (e.g., in 2020 and even 2003), potentially reaching up to 70 CPR. See the details of our data-driven analysis below.

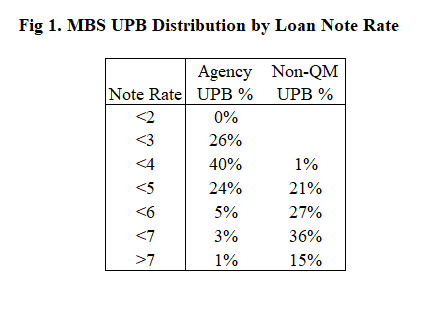

Primary mortgage rates are at local highs, resulting in only about 1% of Agency loans and 15% of the Non-QM universe being refinanceable (see Fig. 1). However, Fig. 1 also shows that if rates rally significantly, nearly a quarter of mortgage loans could become refinanceable.

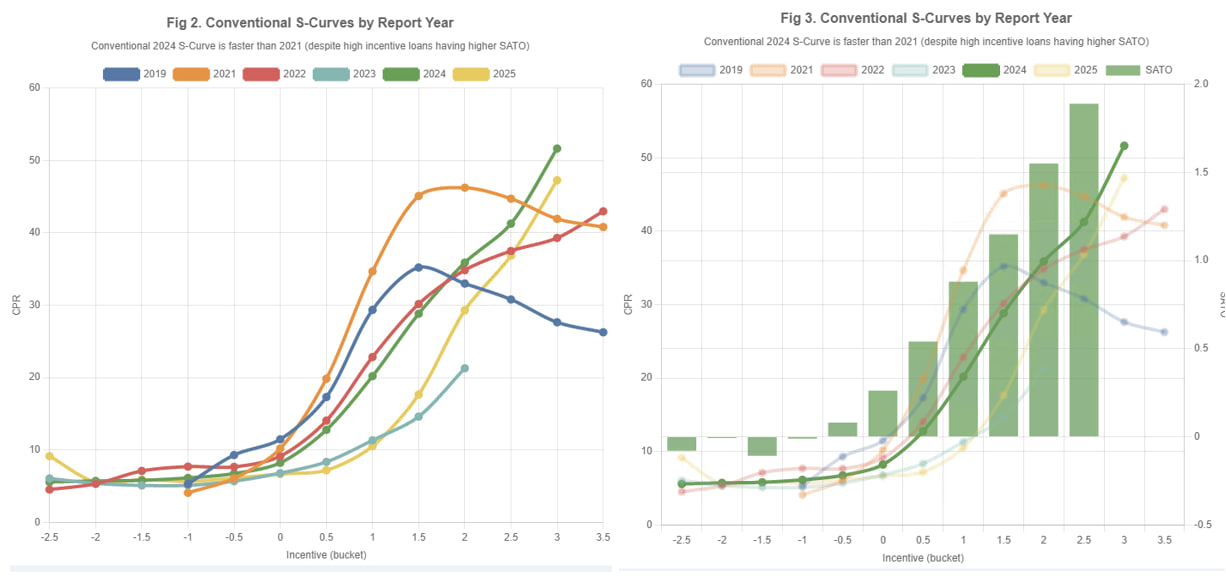

Let's examine the current relationship between the mortgage loan refinance incentive (e.g., loan rate minus primary rate) and the prepayment rate in CPRs, which are called S-Curves. Fig. 2 illustrates these S-Curves by years of prepayment reports. It is evident that the 2024-2025 S-Curves are as fast as those observed in 2020. Therefore, if rates rally, we could experience extremely fast prepayments.

We believe that prepayment speeds could now surpass those observed in 2020, due to the distribution of SATO (spread at origination), shown in Fig. 3. Currently, high-SATO collateral is prepaying at 50 CPR when deep in the money. If mortgage rates rally, low-SATO collateral will also become refinanceable, prepaying even faster – likely up to 70 CPR due to its superior credit characteristics.

Popular prepayment models currently fail to predict these rapid prepayment speeds, just as they did before the prepayment increases in 2020. Consequently, they significantly underestimate the negative convexity of MBS collateral.

Free Trial

The data and analytics used in the figures below can be accessed by requesting a free trial HERE.

Why Choose Us?

With over 20 years of experience and a proven track record in data and analytics development, IVolatility has served more than 500 institutional clients and 130,000 retail customers. Now, we're bringing this expertise to MBS data and analytics. Discover the benefits of using IVolatility solutions for MBS HERE.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the MBS data insights discussed in this post. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.