Year-end Crosscurrents

January 8, 2025

The Markets at a Glance

Happy New Year!

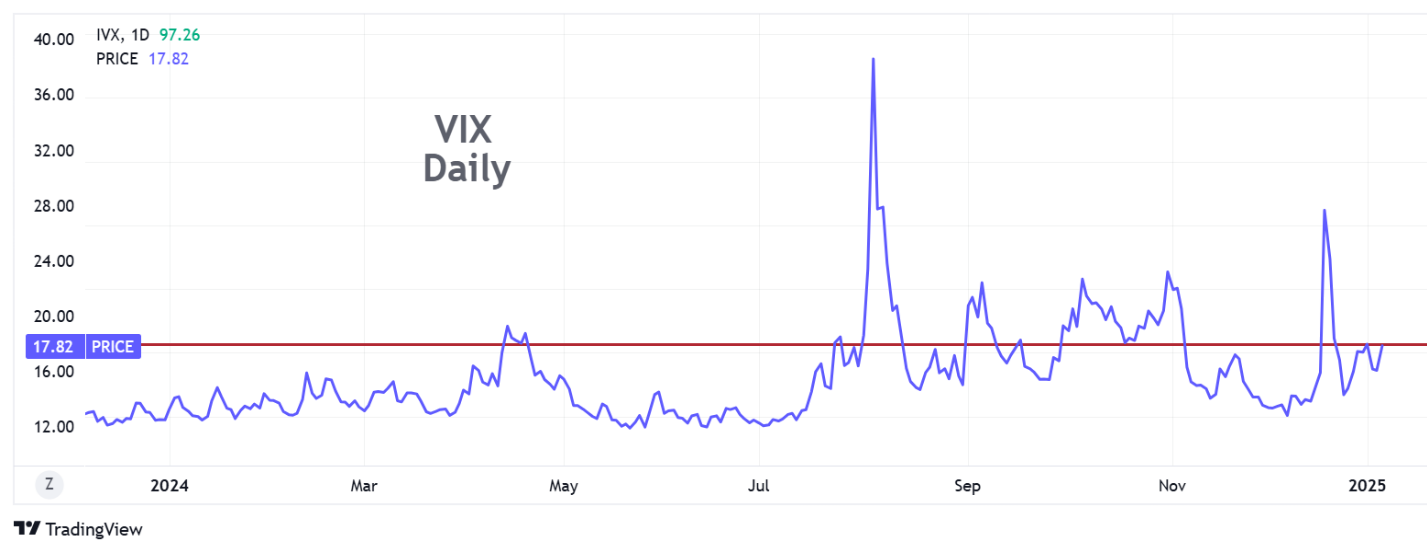

Just after Christmas, the market sold off sharply when the Fed sobered everyone up to expect fewer rate cuts in 2025 and VIX had its second largest spike of the year. While SPY tried twice since then to recover the December high, it hasn't yet and instead is selling off.

Furthermore, the traditional 'Santa Claus' rally did not occur as it normally does in the last five trading days of the year.

And a strong opening today (1/7) was met by heavy selling. (This suggests to me that the underlying trend is weak and that the heavy morning buying is likely coming from mutual funds in 401k plans that have just received year-end company matching contributions that must be invested.)

VIX remains elevated at 17.8.

From a technical perspective, the chart of SPY shows successively lower peaks lately, suggesting that the uptrends of the last 6 and 14 months could potentially be breaking.

That said, there has not yet been a concerted move yet into defensive sectors like Utilities or bonds. So, it could just be some interim weakness in the uptrend and not the start of something more serious. But at the very least, upside momentum is taking a breather.

Strategy Talk: Assessing the Current Situation

The week between Christmas and New Year's Eve has unique characteristics. It generally has subdued volume since many people are spending time traveling or with families. People take action specifically geared to reducing taxes for the year. Institutions take actions geared to structuring their portfolios around year-end reviews. And people frequently use this period to reflect on their strategy, approach, performance, and future risks & opportunities. It is also a period with generally favorable performance and low volatility.

All this, of course, doesn't happen in a vacuum. These actions merely mix with whatever overarching themes and trends are otherwise driving the markets. So, one of the most important things to remember about this time of year is to be cautious about drawing conclusions that may or may not hold valid clues to what will happen in January.

That said, here are some of the crosscurrents that have occurred or may still be in progress.

- Year-end activity in 2024 was very likely influenced by taxes and that, in turn, influences the beginning of 2025. Since 2024 was an exceptional year for the equity market and for bitcoin, it is reasonable to expect that many investors likely held off on taking profits on big gainers in order to avoid paying capital gains tax for 2024, while being more likely to have sold losing positions to capture losses. (Strong stocks like AMZN, META, and AAPL held up well, while weak stocks like FSLR, AMD, and CRUS remained weak into year-end.) That may now be reversing somewhat in the initial days of 2025.

- From a sentiment perspective, the election-related rally may have played itself out. The initial reaction from the election was a powerful affirmation of Trump's win coupled with optimism for business and the economy in the new administration. Bear in mind, however, that virtually all of this optimism was anticipatory. More recently, the Fed pulled back on expected rate cuts for 2025, there was infighting among Republicans on the bill to avoid a gov't shutdown, and economists are saying that Trump's tariffs will be inflationary. The bloom may now be coming off of the election rose and remain off until Trump takes office and begins implementing his economic policies.

- A VIX spike into the high 20s and a sharp one-day sell-off two weeks ago suggest that investors may be skittish about the level of the market overall. While VIX has pulled back since, it remains over 17, which is not low enough to represent an "all clear" signal

- Janet Yellen indicated that "extraordinary measures" may be necessary to avoid a debt ceiling crisis in the next month.

- From a technical perspective, some charts can now be construed as showing the market in a downtrend since the December peak.

- It is also wise to remember that a lot of bonus money and 401k contributions make their way into the markets in early January, which will help to prop things up. Any 401k money that comes in goes directly into mutual funds and then directly into the market. It is essentially automated and is not reflective of conscious buying. The action of the last two days (1/6 and 1/7) suggests to me that there is early buying (common of mutual funds with new money to invest that day) followed by selling later in the day.

These and other crosscurrents may well continue into the first few weeks of January. In addition, Trump's tenure is very likely to be a lot more volatile than Biden's was, particularly with the programs and policies Trump wants to implement and the slim majority Republicans have in Congress. It would certainly be reasonable after such a long run up for the last two years that the market corrects a bit on some of the excesses that have built up.

So, we have elevated volatility coupled with a weaker market, some tax-related selling that is now turning into buying, and some delayed profit-taking from last year's winners. In addition, there is a lot of new money entering the market this month, primarily in broad-based mutual funds from 401k plans. I would expect this scenario to continue at least through the inauguration later this month.

Here's what I'm looking to do:

- Write puts or do covered call writes on stocks that weakened into Christmas and are now recovering.

- Write calls on last year's strong stocks if you still own or have recently bought them.

- Do collars on the broad ETFs to protect against further decline while maintaining long positions.

Remember: The equity markets are closed Thursday, Jan 9th to honor Jimmy Carter.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.