A New Reality Check

December 19, 2024

The Markets at a Glance

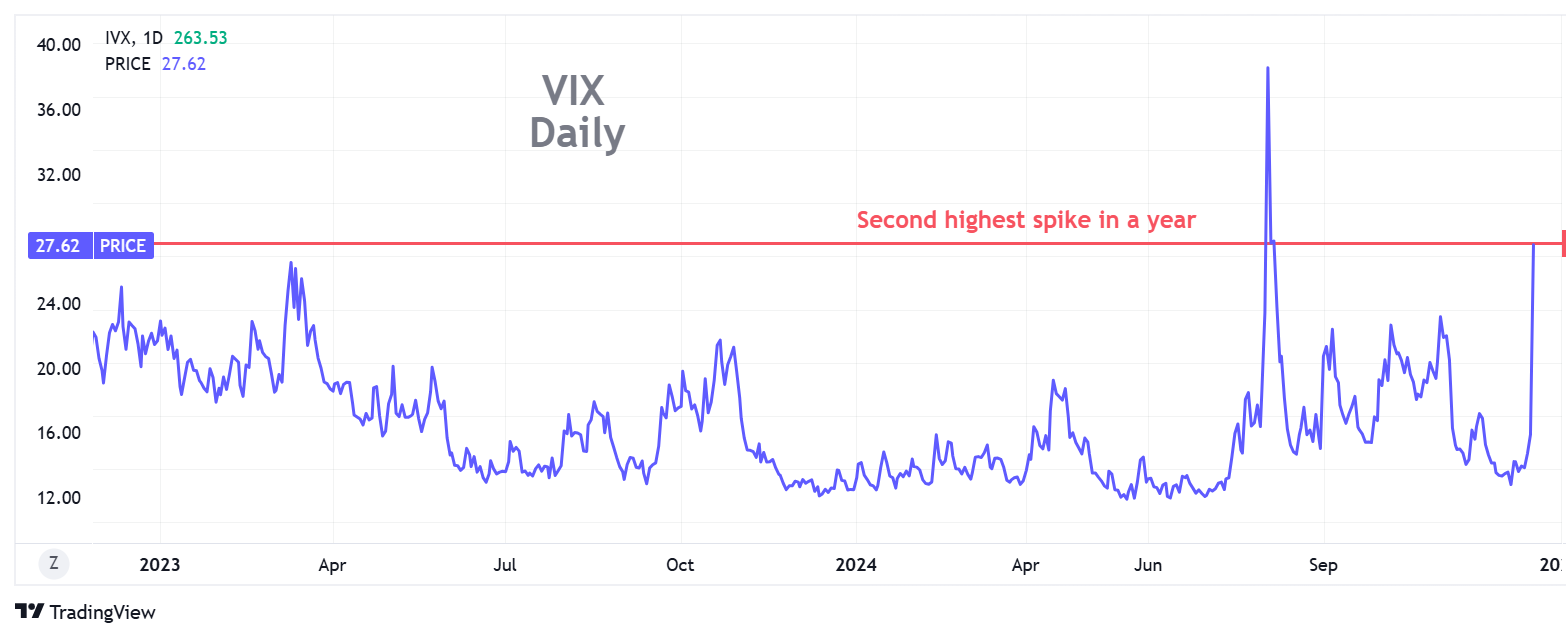

Kaboom! What was more or less an expected move by the Fed jolted the market into a new reality yesterday (Wednesday), dropping the major averages from 2-4% and spiking VIX higher than it has been almost all year, except for the August peak.

As you know from my previous postings, I had been afraid of a sharp correction, given the lengthy rally this year and the election extension without minor corrections along the way. But I was still honestly surprised by the depth of the reaction in the markets. I suspect we will see some bargain hunting on Thursday, but it may take some time for the market to decide how deeply to correct. This type of move could definitely sober things up for a while.

There are also lots of crosscurrents at the end of the year, such as tax selling and window dressing, that will meld with this move over the next week. Selling more losers and small caps was evident today, and if people feel forced to sell some of their big winners before year end, they may sell even more losers to offset the capital gains.

I do not see that the Fed's alteration of next year's rate cut forecast from four cuts to two is all that much of a surprise, nor should it dramatically change the earnings expectations for equities. But the market certainly got strongly spooked today, and with so much in unrealized gains out there and only a few days left to the year, we may not be able to fully assess the next move until after the new year.

The huge spike in VIX suggests to me that lots of people (mostly institutions) are not yet willing to give up on their big tech favorites and bought puts instead. In addition, institutions may want to have their winners on the books for their year-end disclosures. As such, I suspect the selling pressure will ease in the short run, but after Jan 1st that could be a different story.

I am also watching trend patterns on the charts to see if this decline turns into a defined change of trend from a technical perspective. On the SPY chart, I indicate a possible trend support line that could tell us whether this decline can be contained within the former uptrend or not.

For strategy talk today, I'll dispel some of the common thinking about the January effect.

Strategy Talk: Playing the 'January Effect'

With the same reliability as the ball dropping in New York's Times Square on New Year's Eve, the media will no doubt present a flurry of articles around the beginning of the year regarding the 'January Effect'. You should recognize two important things about such articles:

- The media is usually late; and

- They frequently misrepresent the phenomenon altogether

Calendar anomalies such as the January effect and the 'Sell in May' effect are favorite topics in the media, where journalists vying for your attention try to sound intelligent about something everyone already knows about. If you read an article on the January effect and think you are going to make easy money by simply going long equities until the end of the month, then you are doing little more than betting on folklore.

The media-based story about January will typically quote a source like Investopedia, who will tell you that it means stocks have a tendency to rise in January more than other months. The phenomenon was first noted by an investment banker in 1942.

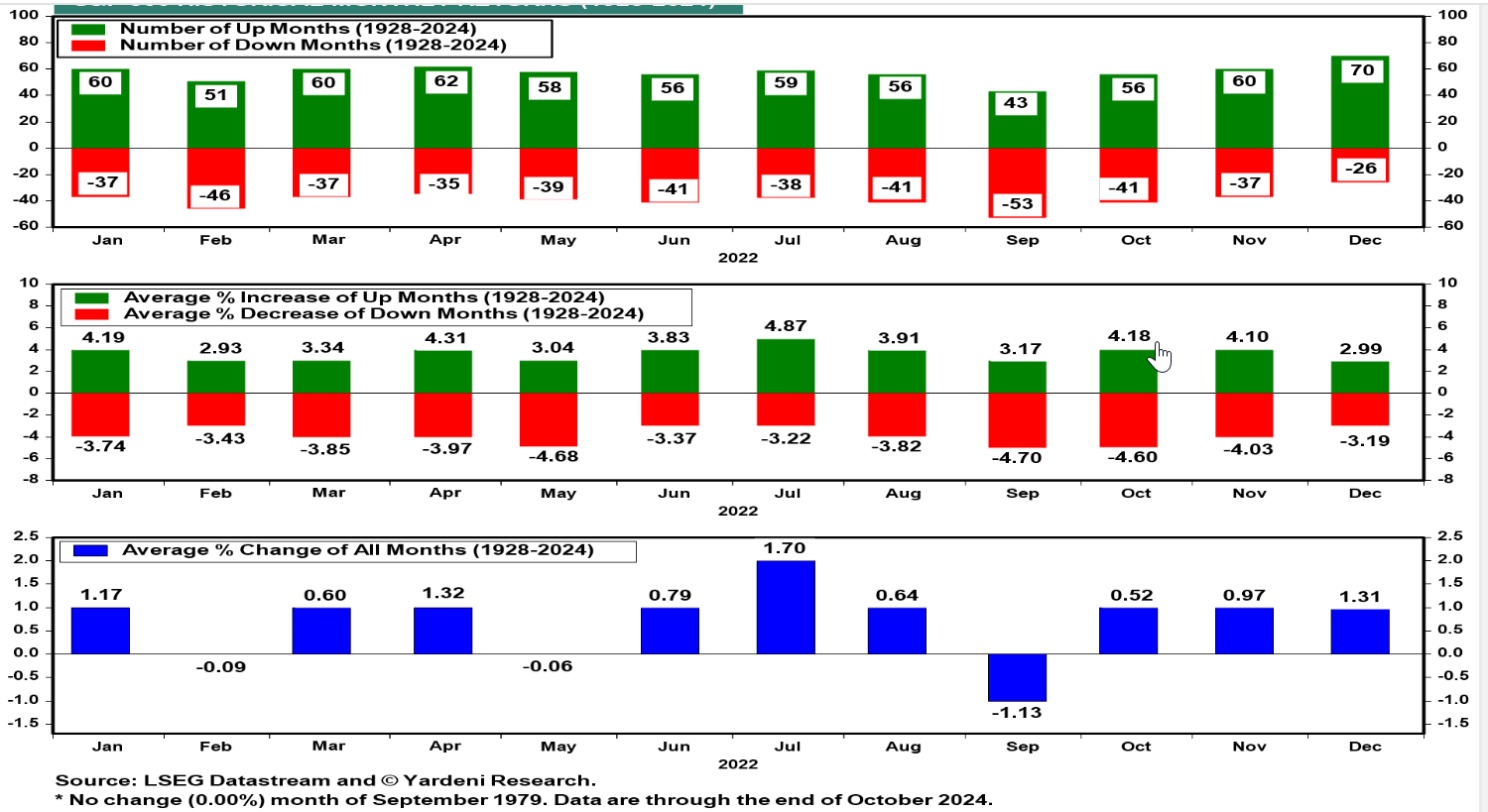

This, however, is not only an irrelevant conclusion, it is also false. The charts below illustrate.

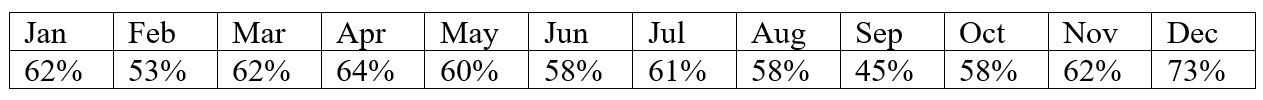

If we take the numbers from the first chart above and compare the likelihood of having an up month in January vs. any other month over nearly a century, we would get the following.

Likelihood of having an up-month

Thus, five other months share or exceed January's track record and overall, January is only slightly better than the average for all months, which is 59.4% wins vs. losses. January also has the fourth highest net gain, so it does not deserve to be singled out for that either. Moreover, December is a better month for stocks than January on both likelihood and magnitude.

So, where's the beef?

You can gain insight on the effect by examining the generally accepted cause, which is acknowledged to be a tendency by many people to sell losers and hold gainers in December for tax purposes and then to repurchase losers in January. Since individuals are more concerned about taxable gains and losses than institutions, one might assume the effect to be further skewed toward small cap stocks.

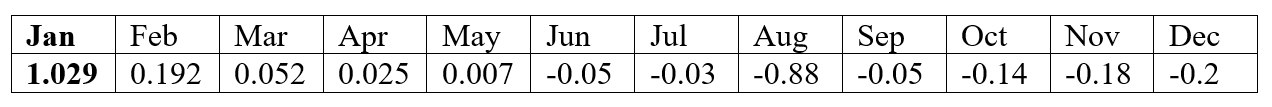

Armed with these insights, if one looks at small cap losers rather than just any stocks, a different picture emerges.

Daily returns by month

But one cannot buy an index or a fund of small-cap losers. Therefore, the so-called January effect isn't really playable.

That said, however, one can incorporate the above effect into one's existing strategy. If you are inclined to put on a long trade for January in the equity market, then it might make sense to use a small cap ETF rather than a large cap to better your odds of success.

The iShares Russell 2000 (IWM), for example, has seen a recent sell-off.

With a significant increase in IV here, a long call will be expensive, but a diagonal using a deep in-the-money call could be worth considering.

An example from Wednesday's close would be:

IWM: 220.84

Long 1 IWM Jan-31 200 call @ 24.40

Short 1 IWM Dec-23 225 call @ 1.40

Net cost = 23.0

(Roll the short side on Dec 23 to a later expiration and plan to hold into January)

And by the way...you may want to initiate your January strategy now as it has been shown to begin during the last week in December.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.