Dividend Capture

December 12, 2024

The Markets at a Glance

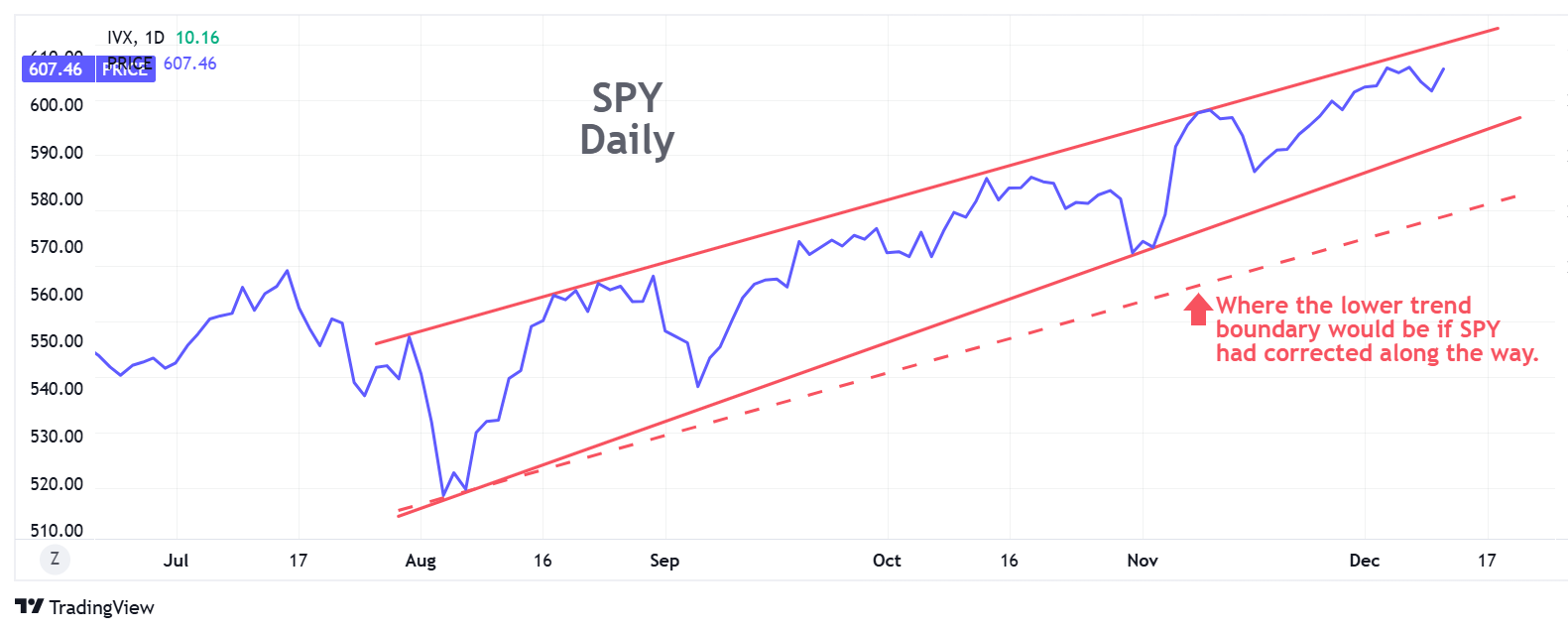

SPY and QQQ both shrugged off the minor declines last week that resulted from geopolitical concerns and are moving up again. But as the charts show, QQQ is bouncing more strongly and clearly again setting new highs while SPY barely touched its existing high. Among other things, the tech sector was buttressed by news from GOOG (up 5.5% Wednesday) that they have developed a chip that can support quantum computing.

While quantum computers are not expected to be commercially available for years, the development of a quantum chip is big news and could breathe even more new life into the tech sector, even with current valuations already stretched by Trump, AI, and bitcoin optimism. Some of the unprofitable smaller players in quantum have been rising from their ashes lately, though their fundamentals haven't really changed at all.

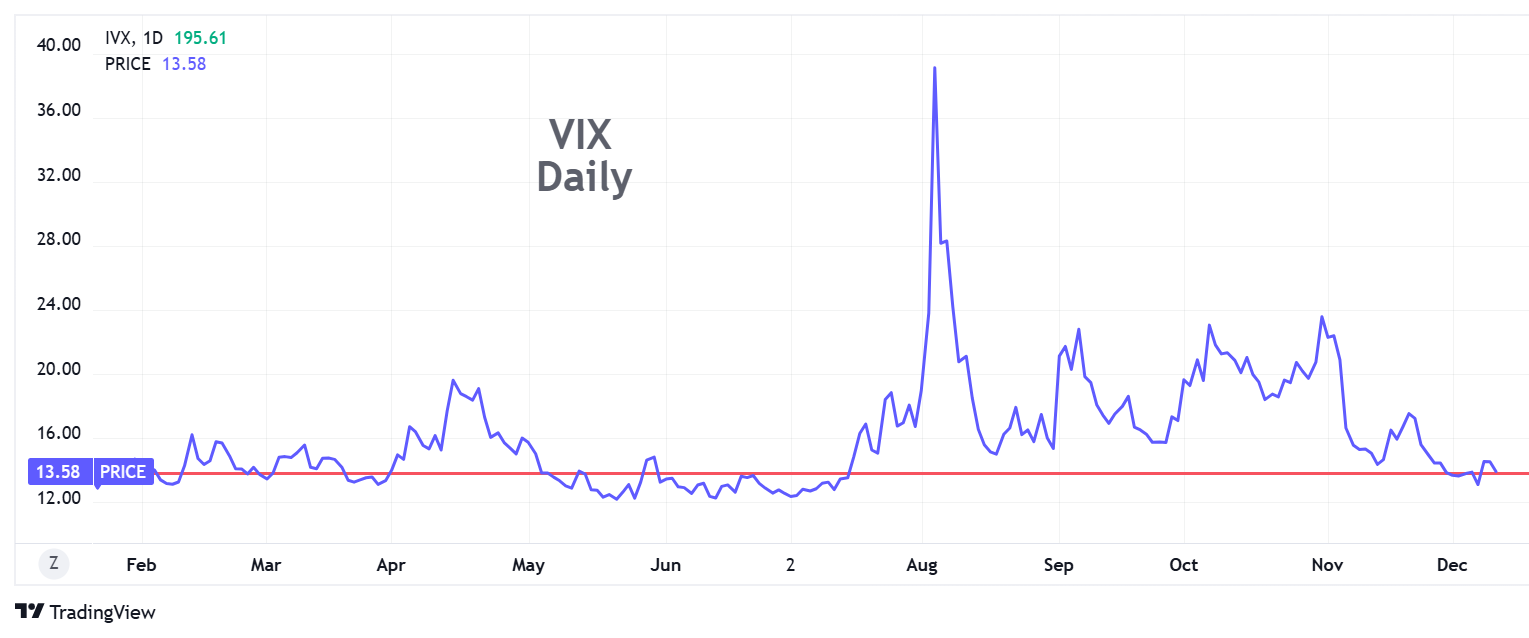

Implied volatility remains low, having risen slightly after the coup in Syria but then falling back again near 12-month lows. It remains a good time to purchase long-dated calls on VIX if you are inclined to use that as a hedge.

All of this plus another rate cut under consideration and the seasonally positive time of year are extending the rally, which still seems to have most of the indicators behind it. Brokerage firms have been issuing new and higher estimates for 2025 as well.

As for me, I remain long but well-hedged and I continue to look for falling stars rather than chasing stocks that are going vertical.

Strategy Talk: Dividend Capture

For option traders who are long calls, dividends represent more of a problem than an opportunity, since the dividend reduces the underlying's value and the call owner doesn't get any of that. Covered call writers need to watch out for dividends as well, since they affect call premiums and can sometimes lead to an unexpected early assignment. And for quick traders looking to catch a stock on a dip, an upcoming dividend is probably not even on their radar.

Nonetheless, dividend capture has long been a favored institutional strategy and dividend arbitrage a popular practice at hedge funds. At the very least, it pays to know if you are trading options on a stock or ETF that is about to give a dividend. Sometimes, however, it can even be part of your strategy.

I bring this up because I own SPY as a core holding on which I trade options and it is about to pay a dividend on Dec 20th. The yield on SPY is small from a dividend perspective, currently running at around 1-1.5%, but if you are wondering why you cannot get as much call premium as you like or why put premiums seem high for the Dec 20 expiration, it's because of the dividend. On the 20th, SPY will trade ex-dividend by around 1.40, give or take .10.

Tip: As you are scanning option chains, your best clue that there is a dividend coming is when the implied volatilities on puts are all higher than the implied volatilities on calls at the same strike and expiration. The Black-Scholes formula does not consider dividends (unless they are externally figured in), so BS shows a distortion in theoretical values as a dividend approaches. In non-dividend scenarios, put-call parity keeps the IVs very similar between the two types of options.

When Kohl's (KSS) tumbled a couple of weeks ago from 18 down to 13.75, traders were probably not focused on the upcoming 12/9 dividend, which was already announced at $.50. This presented an extra opportunity for covered writing. The drop produced an attractive price and rich call options for a covered call write with the $.50 dividend a bonus. It also helped support the price of the stock as dividend players would likely swoop in to capture that dividend once they saw the stock sell off.

If you are intentionally looking to capture an upcoming dividend, you will need, of course, to own the stock on the record day. You can write a call to hedge the position, but if the call is in-the-money and has no time premium a day or two ahead of the record date, there is a good chance your stock will be called away prior to the ex-date. (A favorite arbitrage strategy for hedge funds is to buy stock and write ITM calls in the expiration immediately following the dividend. If the stock is called away prior to the dividend, they haven't lost anything and if it doesn't get called away, they capture the dividend and then get called away anyway.)

So, you want to write an out-of-the-money call to prevent being assigned prior to the dividend. If you cannot get much for such a call, your long position may simply get you a dividend followed by a reduction in stock price that nets you zero profit from your position, but if you do get some reasonable call premium, you may collect both the premium and the dividend. (Remember also that traders and hedge funds who are looking for the dividend may sell right after it is issued, thereby putting post-dividend sell pressure on the stock.)

For these reasons, I like to own a long put on the stock, preferably in-the-money, so that I guarantee the post-dividend price I can get for the stock. To offset the time value in the put, I would also look to sell an OTM call.

For the upcoming SPY dividend, I already own the shares along with long puts for January and I write almost daily OTM calls against that position (more on that strategy in the next issue) so the dividend just adds a little extra gravy to my return.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.