Improve MBS performance predictions by 17% with HMDA data.

December 6, 2024

In addition to various GSE and Ginnie Mae loan-level underwriting and performance datasets, we are now hosting HMDA (Home Mortgage Disclosure Act) loan-level data. This dataset enables professionals in both Capital Markets and Mortgage Lending to make more accurate decisions regarding pricing, risk management, marketing, and underwriting.

Capital Markets professionals benefit from a 17% improvement in loan performance predictions (e.g., prepayments and delinquencies), allowing for more precise pricing and risk management decisions.

Mortgage Lenders leverage this data for competitive analysis against peers, achieving a 10% increase in pool pay-ups, a 25% reduction in marketing costs, and a 15% improvement in recapture rates.

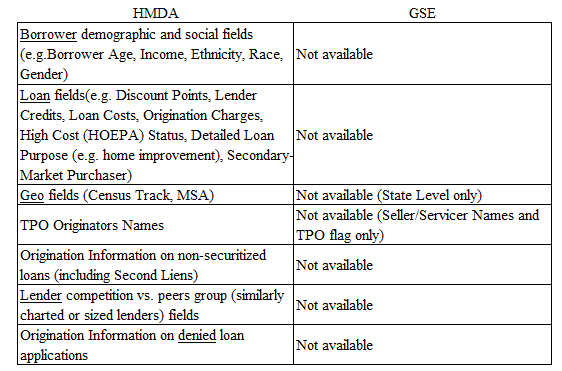

The table below illustrates how HMDA data complements traditional GSE and Ginnie Mae datasets:

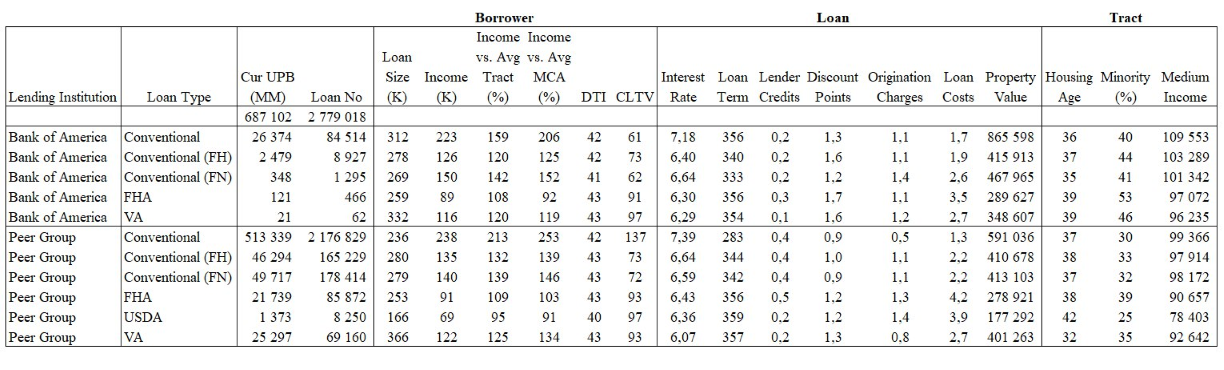

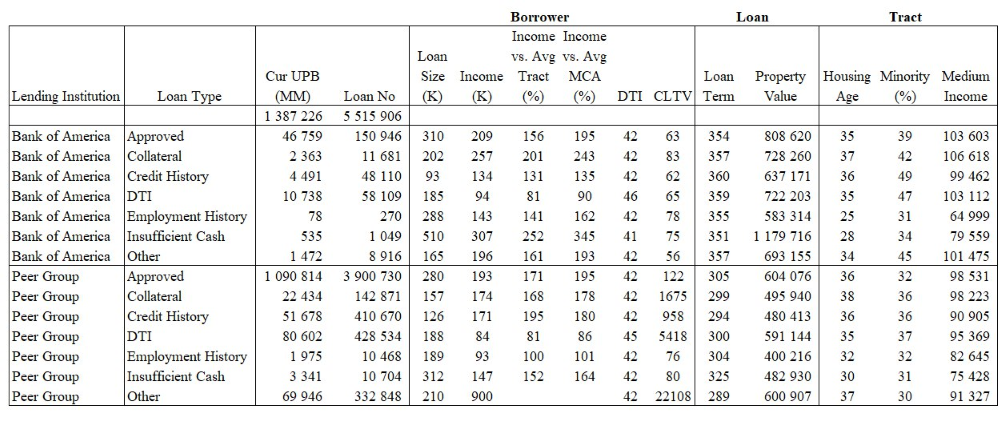

The figures below compare the Primary Market and Origination report to its Peer group for a sample lender institution. This analysis can be customized based on client requests.

See more details at:

Run the reports at:

Fig. 1 Primary Market Report: BOA vs. Peer Group

Fig. 2 Origination Report: BOA vs. Peer Group

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the MBS data insights discussed in this post. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.