Put Hedging

December 5, 2024

The Markets at a Glance

SPY and QQQ hit new highs again this week, following a miniscule pullback that appeared to be the result of geopolitical flareups in France, Syria, and South Korea. Neither of these incidents put a dent in the overall trend, which remains up.

Global markets are looking stronger, despite these situations, which may just be so common now that the markets tend to ignore them. Meanwhile, the bullishness in the US equity market is likely setting the tone for at least some of this strength.

Domestic equities seem to be maintaining the optimism generated by the election, which is now taking its cues from cabinet picks that are expected to be pro-business, largely by reducing government regulations and constraints.

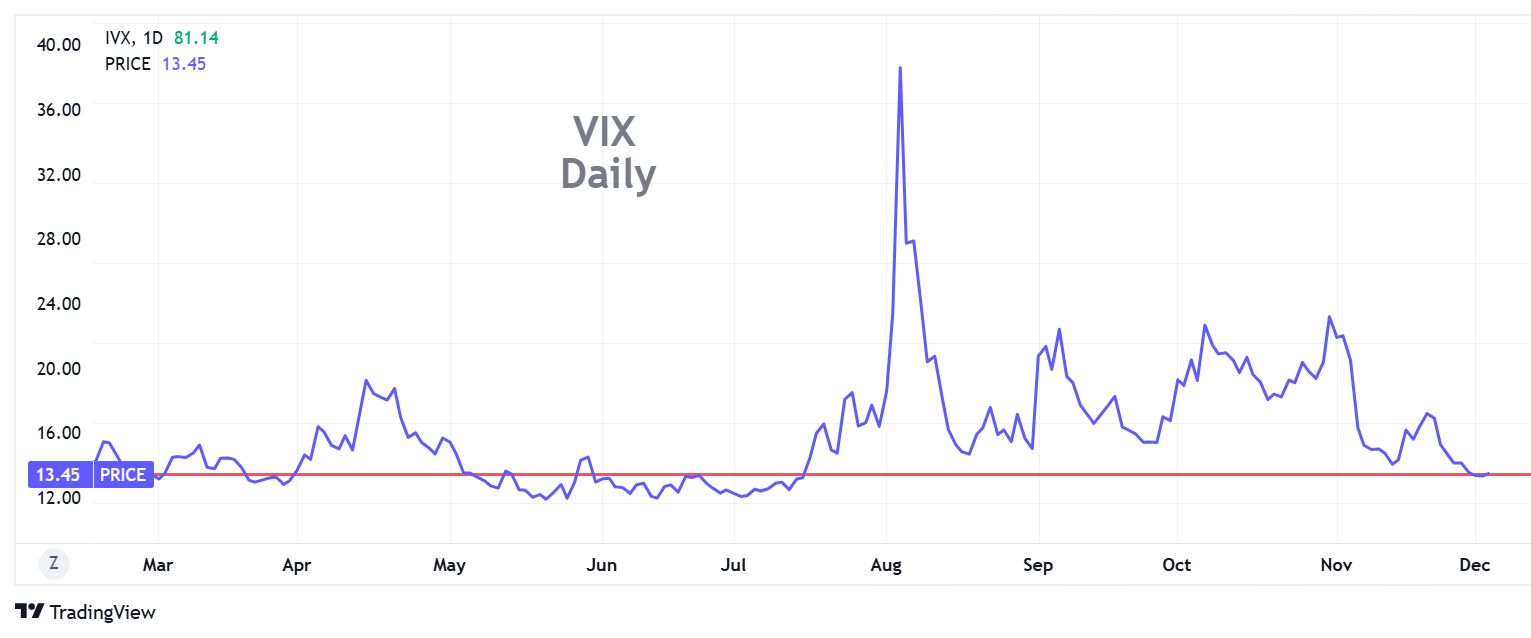

Implied volatility on the S&P 500 remains calm and at a level below most of the readings over the last year.

The only signal I see that suggests the trend might take a breather is a contrarian one – the fact that both SPY and QQQ are back to the top of the trendlines for this multi-month advance and that the trend still appears to be a long contracting triangle which tends to save its correction for the end of its move rather than correct along the way.

The most bullish item in the news lately has not been a stock but has instead been bitcoin. The anticipation of a new SEC Chairman who will be more friendly to crypto has helped bitcoin top $100,000. That puts bitcoin's total market capitalization up there with the world's largest public companies. Not bad for a figment of technical imagination that has no business, no hard assets, and a seldom used business case.

Bitcoin does, however, now have ETFs and options that provide us with the ability to play it like a stock, hedge positions, generate income, or trade its volatility. I have started doing some covered call writing on IBIT and we'll see where that goes.

To continue our discussion of hedging this week, I will discuss put hedging.

Strategy Talk: Put Hedging

Institutions, people with existing equity portfolios, and professional traders all recognize value in the ability of options to hedge an existing position and there are a wide variety of both put and call hedging strategies available.

First, why use long puts to hedge at all? They cost money, like buying insurance, and will therefore reduce returns no matter what. Writing calls, even if in-the-money, will take in premium rather than spend it and will therefore enhance returns, though sacrificing upside.

It's a valid question. Since long puts do require an outlay of capital, they are used as a short-term or temporary hedge and are used more sparingly and intermittently. They do not represent an attractive strategy (by themselves) for regular ongoing implementation, the way covered calls do. They can, however, be combined with short calls to offset their cost.

So, why are long puts used to hedge at all?

The advantages of hedging with long puts over short calls include:

- No risk of early assignment (which can be especially important when there is a dividend approaching in the underlying stock)

- Protection all the way to zero on the underlying stock (which is a lot further than the deepest ITM call can usually provide, since really low strikes are not generally available.)

- Theoretically unlimited upside still exists with long puts (less the cost of the put, of course)

- Ability to hedge a portfolio of stocks by buying puts on an index or ETF (This is the big advantage for institutions.)

So, unless one of these advantages is important for a specific situation (such as a stock that could have a significant upside from a takeover, for example), writing call options is the more attractive ongoing hedge strategy, or perhaps a combination of long puts and short calls to create collars.

ITM vs. OTM put hedges

If you do feel that a put purchase is the better strategy in a given situation, which one do you buy?

Since puts are a cost as well as a capital outlay, the natural tendency is find a cheap one and to go out in time only as far as is deemed necessary. This kind of thinking may not always be optimal.

Buying an inexpensive OTM put will limit your cost outlay as well as the cost of the hedge itself (which is the time premium on the put you purchase). But it will leave you exposed to a loss down to the OTM strike selected (plus the time premium paid).

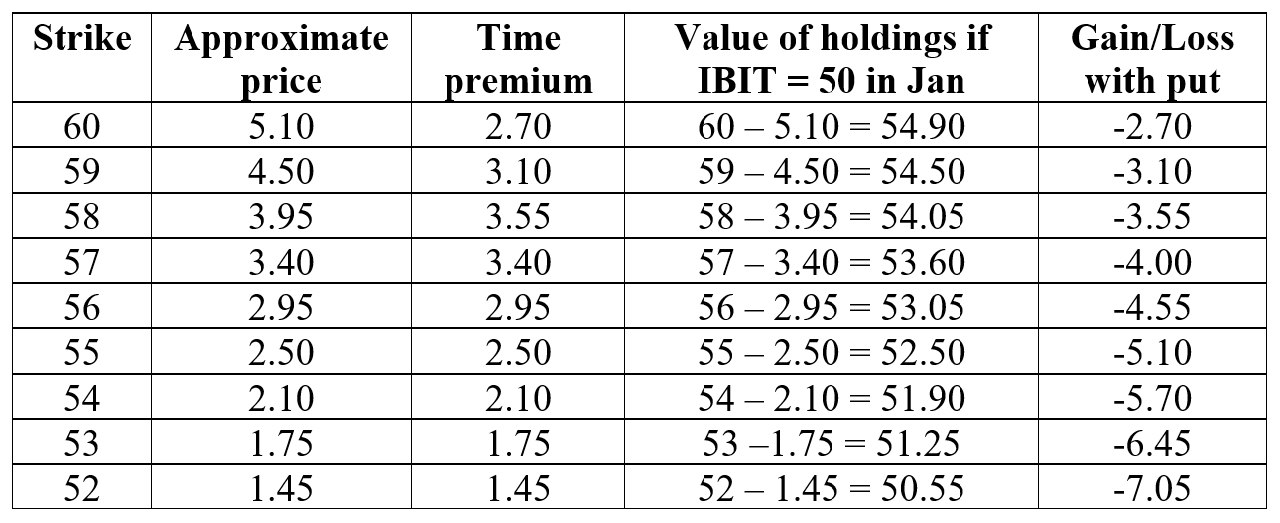

Let's take an example. If you had purchased the iShares Bitcoin Trust (IBIT) a couple of months ago in the low 30s, you could be sitting on shares worth about 57.60 today (Wednesday) and you might want to hedge that until at least January to avoid paying a capital gain tax on it this year. Put prices for the Jan 3rd expiration are approximately as follows:

Jan 3 '25 Puts on IBIT @ 57.60:

The point of this illustration is to show that buying a cheap OTM put such as a 52-strike is almost completely ineffective unless the stock goes much further down, though it does allow more upside. Conversely, the ITM 60-strike requires a larger outlay, but provides much better results should the stock decline. So, the cheapest option is not necessarily the best, especially if a decline does occur. Also the possibility of further upside has an important impact on the performance of a put hedge and should be considered when selecting the appropriate strike to use.

In the case of IBIT, which has high volatility and expensive options, a collar is probably the best overall strategy as it could reduce the cost of any put purchased, while taking advantage of high call premiums.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.