Bitcoin ETF Options Have Arrived

November 27, 2024

The Markets at a Glance

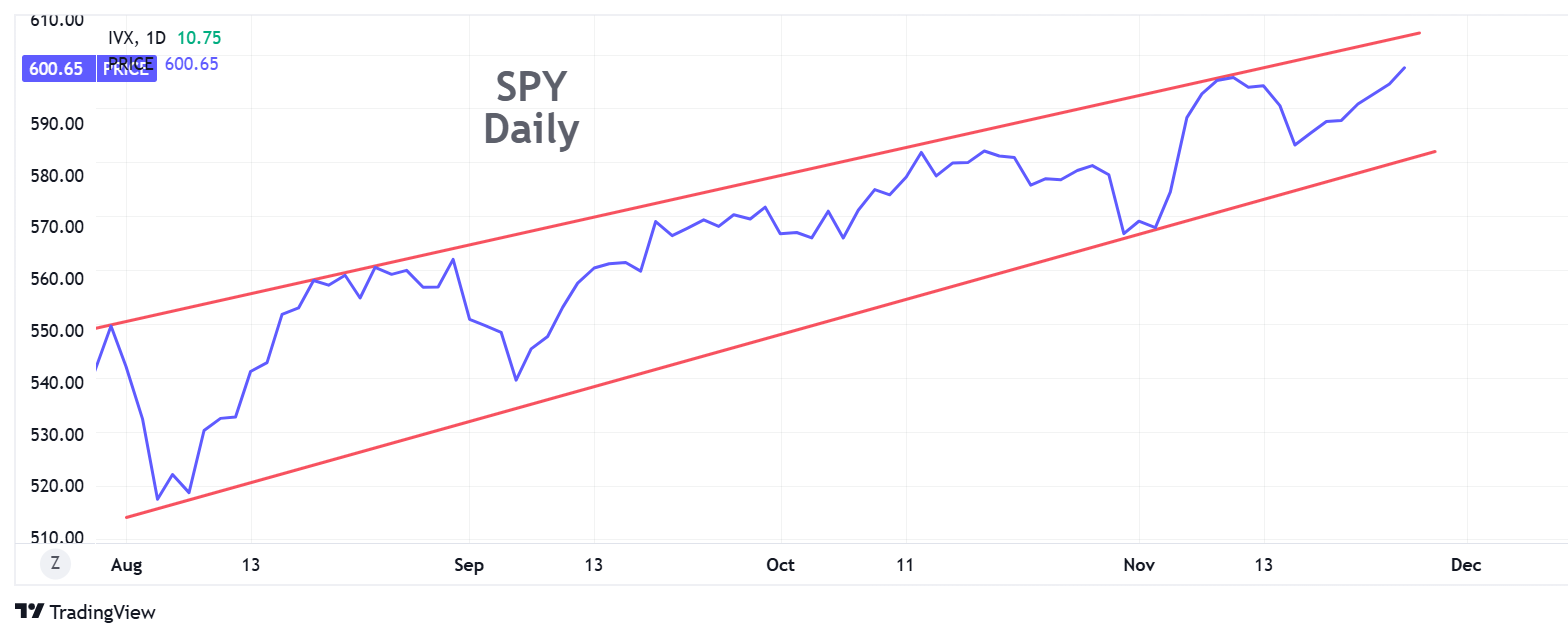

SPY continues in its year-long uptrend, which still looks to be contracting as it progresses. I read that as a strong trend but one that is not fully correcting along the way and therefore somewhat worrisome as being over bought. That does not, however, indicate an imminent correction – just that few have occurred as this trend has progressed.

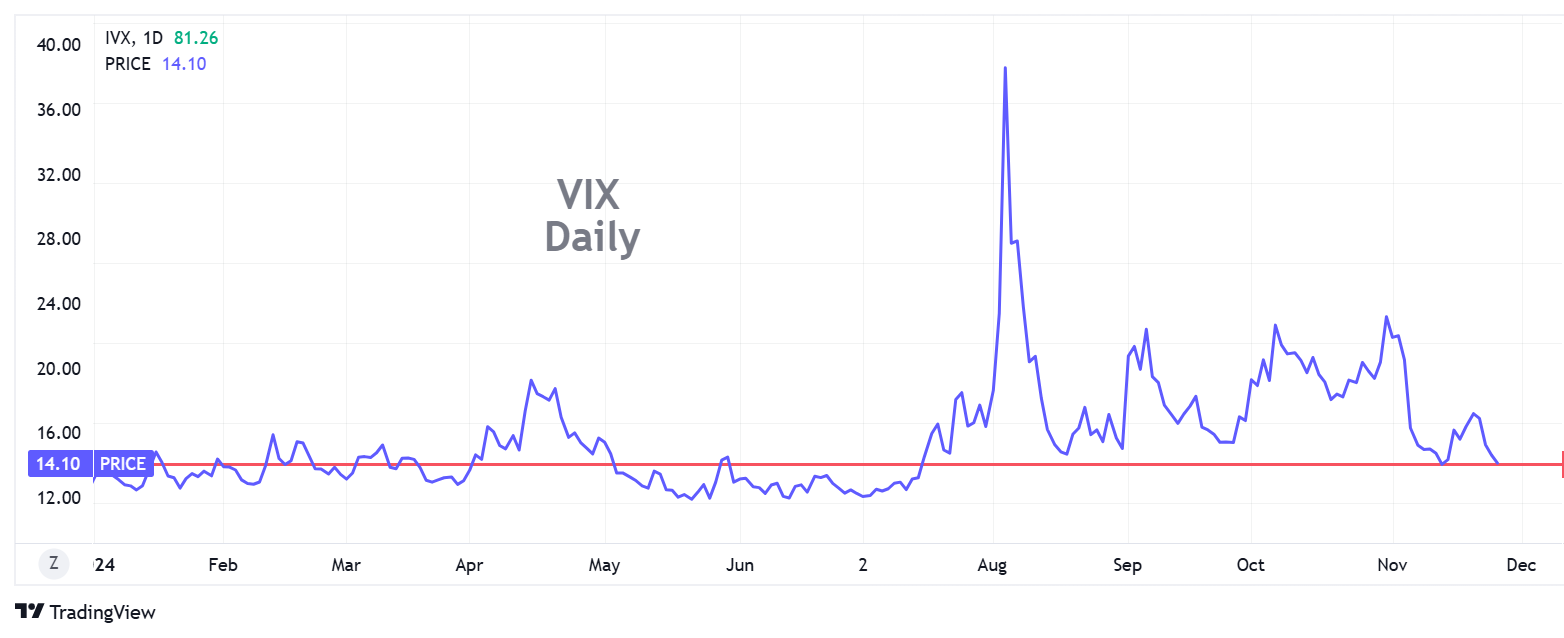

Unsurprisingly, implied volatility has dropped since the election week frenzy and the broad market in stocks has been relatively subdued during the Thanksgiving holiday week. VIX is back down near 14 as both SPY and IWM squeezed out new highs. QQQ did not quite make a new high this week but is not far from one.

The fact that implied volatility has dropped does not necessarily signal another big up leg coming for stocks. It may simply be that the election-related volatility has subsided and the institutional community no longer feels the necessity to be long puts for protection. It does say that the path of least resistance still points further upward, though the time horizon for that in most people's minds may not extend much further than January or February.

The year-end is generally a good period for stocks, though also a less active one, so the market can creep upward or even have a mild correction and not create a stir until January (geopolitical surprises notwithstanding). Also, in a very positive year such as this, retail investors will tend to hold their gains until the next tax year if they can, especially if they believe taxes will be lower next year.

That said, there are a growing number of experts pointing to current valuations and saying that stock gains in recent years have far exceeded earnings gains, thereby raising P/Es to levels that are generally unsustainable for long periods. My sense is that Trump's victory lap rally is largely over and will be re-evaluated in January or February when it becomes more apparent what his administration will do. Meanwhile, the more immediate goal for many folks will be to hold on to gains until next year to avoid a big tax bill.

The big news in options recently is the introduction of options on bitcoin ETFs. I will discuss that further in today's strategy section.

Strategy Talk: Bitcoin ETF Options

If you are a bitcoin player or someone considering it, this is a big development. It is now possible to employ equity option strategies on select bitcoin ETFs. This opens up a variety of opportunities to hedge existing bitcoin holdings, generate income from bitcoin assets, or enter new positions using the full array of conventional options strategies, such as covered call writes, spreads, puts, etc.

Until now, the only bitcoin-related options in the equity markets were on the bitcoin futures fund (BITO) and the stock Micro Strategy (MSTR), which has become something of a bitcoin proxy as a result of its large holdings. Neither of these represented an efficient way to employ option strategies on bitcoin. The futures ETF is a very short-term trading instrument with a low correlation over time to bitcoin itself. MSTR is a highly leveraged public corporation that keeps issuing stock or borrowing money to buy bitcoin. As a result, MSTR is not a pure play on bitcoin and its bitcoin holdings are bought and sold at the whim of the CEO, and thus not stable.

The news is that the CBOE has now opened conventional equity option trading on three bitcoin ETFs and will also trade options on select bitcoin indexes beginning on December 2nd. The first bitcoin ETF to have options was BlackRock's iShares Bitcoin Trust (IBIT). IBIT is technically a trust rather than a fund but works essentially the same way and is broadly categorized as an ETF or ETP. Shares of the trust have traded almost entirely within 1% (plus or minus) of its actual NAV since inception and usually much less. (Details from the issuer are available here.)

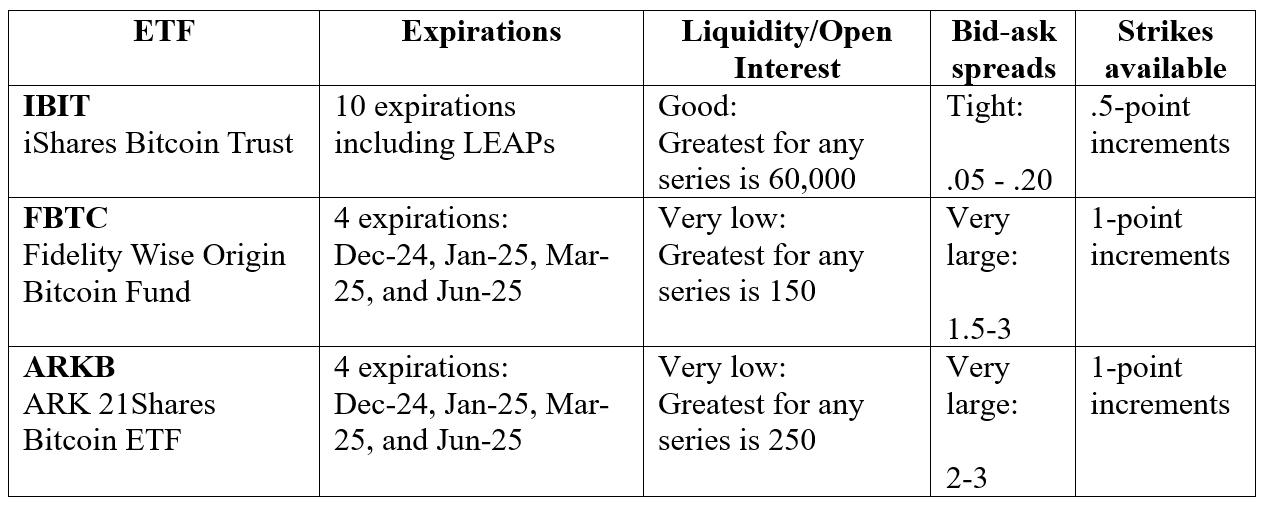

Of the three Bitcoin ETFs with options, IBIT has been the most actively traded by far and the only one with a reasonably liquid options market. The other two have very little liquidity thus far, presenting significant challenges to almost any option strategy.

Here is a rundown on the three Bitcoin ETFs and their options:

The implied volatility of ATM options on IBIT is around 60% in all expirations. It will be interesting to see how this changes over time and whether skews will appear.

The ability to do conventional option strategies such as put hedging, shorting, covered call writing, and spreads adds a significant new dimension to Bitcoin investing while adding a volatile new instrument to trade for experienced equity option players. Personally, I'm excited to see this finally happen and to see good liquidity right from the start.

Happy Thanksgiving to all!

/Rick

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.