The Volatility in Front of Us

November 21, 2024

The Markets at a Glance

Stocks continue to be influenced by the impact of portfolios being realigned to the expected policy changes of the new administration. But the broad market is a bit less ebullient and has declined from the initial post-election highs. SPY and QQQ are down 1.5-2.5% from their highs and IWM is down about 5%.

The year-long uptrend remains intact, so nothing from the election trading frenzy suggests that imminent danger is near. The pundits may not be happy with a lot of the wild ideas coming out of the incoming administration, but the consensus from both sides of the political spectrum acknowledges that tax cuts, tariffs, relaxed regulations, and further interest rate cuts are as good a backdrop for the market as one could expect.

Earnings estimates on the S&P 500 are expected to rise nicely next year, perhaps in the double digits, though they are getting reduced now as they always do at this time of the year. It seems the only counter arguments to a continuing rally are the current valuation of 22x earnings and the expectation that Trump's economic and immigration policies will be inflationary – the very thing about the economy his fans voted him in to keep low.

Implied volatility has inched up as VIX hit 17 and had reached beyond 18 earlier this week. This jives with the chatter in the media this past week which has moved on from election second-guessing to the reactions to what the new leaders might or might not actually accomplish and what effects that will actually have on specific companies and industries.

Some additional escalation from current global hotspots spooked the market for a day or so, but when WWIII did not break out, the attention returned quickly to domestic issues.

Given this rather optimistic and benign outlook for stocks, my thoughts this week are on volatility – will we see more or less of it next year?

Strategy Talk: Bracing for a More Volatile Year...or Not

The period between Thanksgiving and Christmas generally brings a degree of relative calm to the US markets as people turn their attention to year-end performance, tax planning, and family activities. Next year, with a new administration that has stated intentions for turning up the heat in a number of areas, it might be a good time to think about your strategy for dealing with, protecting against, or even exploiting implied volatility. For options traders, direction will always be critical, but there are also big risks and opportunities that revolve around volatility. We should all have a plan for it.

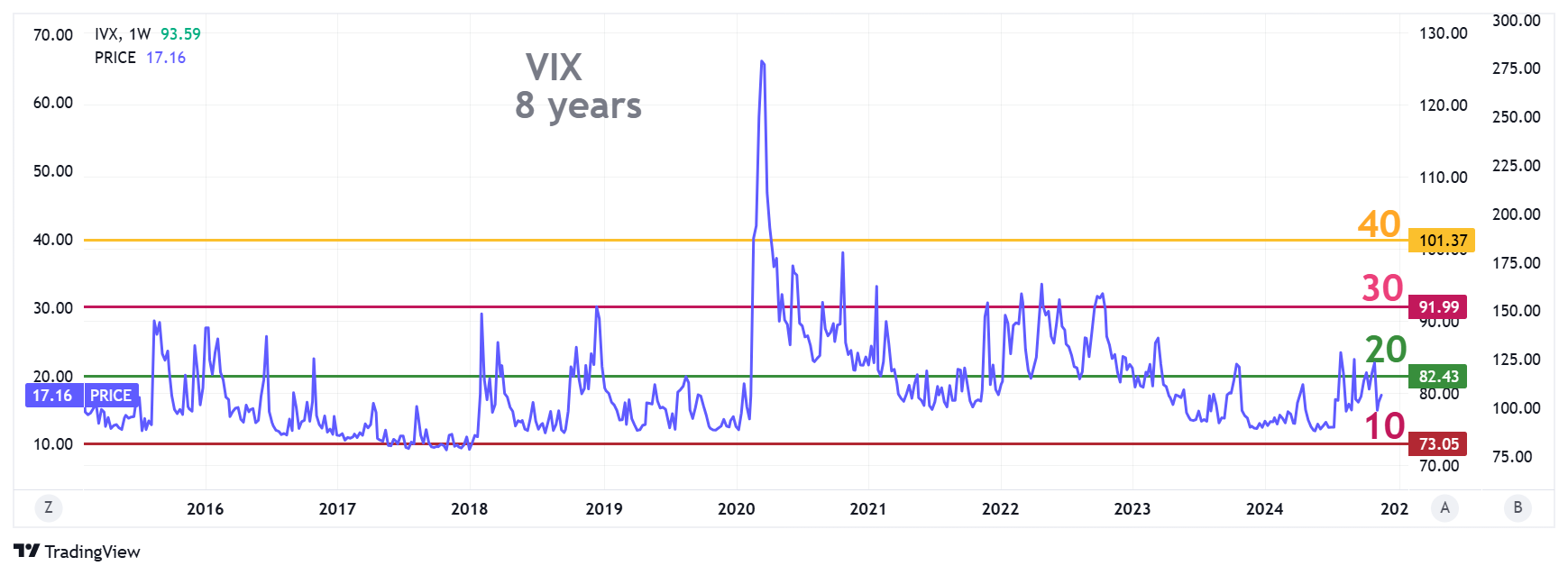

For perspective this year, I looked at how VIX performed during the first Trump presidency and then the Biden presidency. Below is the chart on VIX for the last 8 years.

From this chart, we would conclude that even without the volatility spike caused by the Capitol riot in January 2020, volatility was notably higher during Biden's rein than Trump's. That, however, must be viewed in light of the Covid pandemic during Trump's time in office and the inflationary scenario present during the Biden era.

Given those and other contributing factors, I would be very hesitant to conclude that we should expect relative calm during the upcoming four years, especially when you zero in on January 2020, which was certainly more attributable to Trump's actions than Biden's.

I find it more instructional to view implied volatility for its inherent characteristics rather than who might be in the White House. I also feel that we should view volatility for its unpredictability rather than its predictability. By that, I mean the magnitude and frequency of its moves, especially its recurring spikes.

Even when implied volatility was relatively low between 2016 and 2020, it ranged from near 10 to as high as 30. During those years, there were also six times (once every few months) when VIX rose above 20. During the following four years, VIX spent as much time above 20 as below and had the big spike into the 60s.

The important thing to realize is that spikes in implied volatility occur for the things we cannot anticipate. Nonetheless, such surprises occur often and with considerable magnitude. That's important for option traders as it results in substantial changes to option premiums during those periods.

So, as I see it, the important thing looking forward is not whether implied volatility is expected to be relatively low during the next four years but to expect that for reasons we cannot currently anticipate, it will spike upward numerous times.

Knowing what or when those spikes will occur is impossible. But imagining what would cause those spikes is not difficult at all. Trump and his team are political wildcards. They do little to hide their intentions to shake things up. The new administration represents a big challenge for financial analysts as the level of uncertainty about policy changes is much greater than usual, given the rather dramatic pronouncements made by the new President and now his new cabinet picks as well. We should expect this to continue for some time, since it will be months before we know exactly what changes are coming and can assess their impact on public companies.

The economy is always full of surprises, no matter how outwardly stable. Few are calling for a recession or other imminent financial catastrophe on the domestic front but the US is setting itself up for some very divisive politics, congressional battles, inflationary policies, and possible trade wars.

The geopolitical situation is always full of potential events that can create spikes in implied volatility, and the unrest in several places around the globe cannot be expected to fade away anytime soon.

So, for options traders, the question is: How do you integrate the likelihood of implied volatility spikes into your ongoing strategy? A few possibilities might include:

- Buying VIX calls to hedge your portfolio when it is low (say below 15)

- Planning portfolio changes or broad market trades to make when VIX spikes

- Planning key stock trades to make when implied volatility on any of them spikes

- Planning how to protect against volatility spikes when trading other factors, such as direction, or time decay.

In future weeks, we can look at each of these scenarios further. For now, just set aside some of your end-of-year quiet time to think about how volatility affects your current strategies or how you might want to exploit it with new strategies.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.