The Ins and Outs of Hedging with Options

October 31, 2024

The Markets at a Glance

As of Wednesday's close, SPY and QQQ are having difficulty maintaining their upward momentum. While they have not definitively turned south yet, both are getting squeezed by the triangles they have formed since their August lows and are looking more and more like they will exit to the downside.

Watching the daily action this week, I note that the broad indexes appear to be 'fluffing' in the same way that sailboats do when the wind dies down. As I mentioned last week, I sense that investors have already baked the soft landing into market valuations and potentially the same for AI euphoria (at least temporarily). And with the end of the year in sight, I expect a lot of investors and professionals are feeling the temptation to lock in the year's performance right here.

The election also still holds a lot of uncertainty and according to recent polls, the high level of anxiety on both sides of this election has a majority of people believing there will be some kind of bedlam regardless of who wins. With that thought hanging out there, it would not be hard at all to see some folks take money off the table, call it a good year, and try to stay out of the post-election craziness in whatever form that takes.

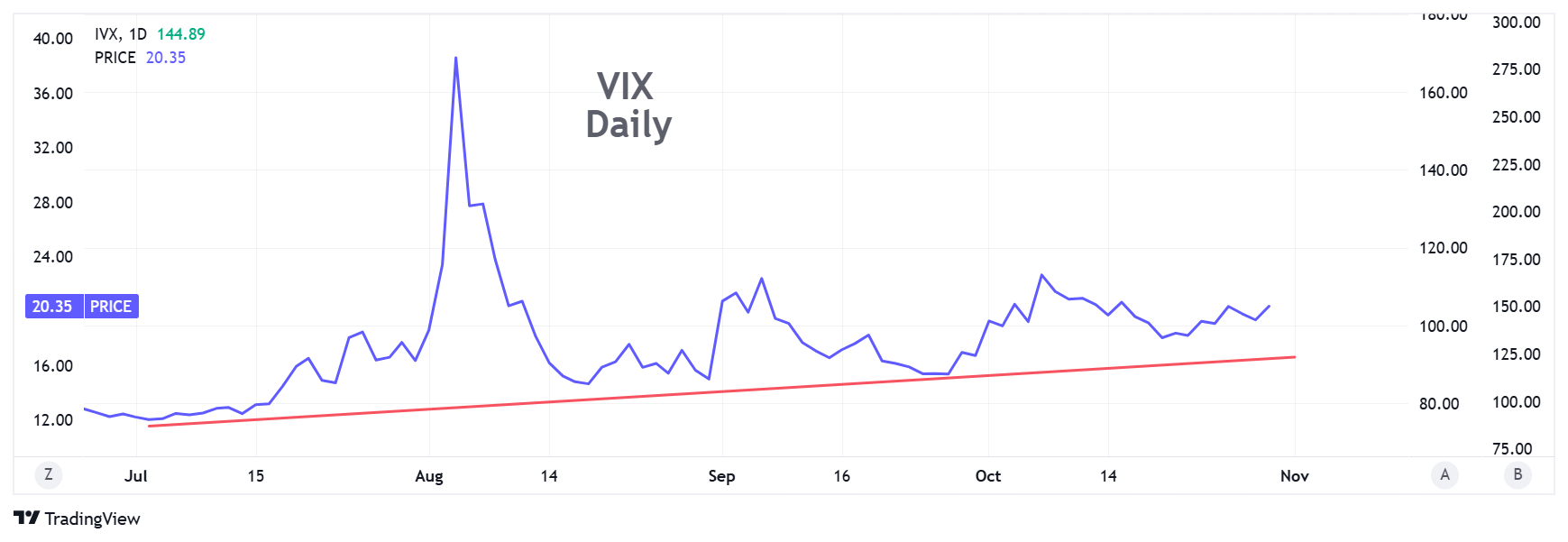

The VIX has been hovering near 20 and has been on the rise since mid-August, which says the institutions are keeping one eye on the exits here, even as they remain heavily invested. That says to me that they might begin selling at the first sign that a market top may be forming.

Also, there are a lot of earnings announcements coming in this week to raise even more questions. If good earnings can lift the market higher in the near term, we might even set more new highs before the year-end. But if earnings are mixed and good earnings lead to profit-taking, then I believe we are in for a drop here.

I am still a believer that in a positive environment, falling knives can offer some very attractive trading opportunities (witness Citigroup, McDonalds, First Solar and others) as people buy the dips. But if the overall market turns south, I would abandon that strategy for a while.

Strategy Talk: The Ins and Outs of Option Hedging (First of a Series)

The difference between a speculative investor and a professional option trader can often be summarized in a single word – hedging. Individuals who are relatively new to options scoff at the idea of hedging, perceiving it as an activity reserved for those with weak convictions or those managing large portfolios who are obligated to placate overly conservative regulators, trustees, or clients. In addition, hedging is frequently seen as being synonymous with sub-par returns.

These perceptions are naïve and untrue. Market makers, hedge funds, and other professional traders know that hedging is not only one of the strongest characteristics of option trading, but also the key to profitable long-term trading. In contrast, individual traders tend to take too much unhedged risk and lose their capital. An executive at an online brokerage firm once told me that his firm was not very excited to open new option trading accounts for individuals as they typically ran out of capital in 6-9 months.

The impetus for creating formal option exchanges in the US was not because individual investors pressured their brokers for another trading instrument. It came largely from the institutional community who pressured the exchanges and regulators for ways to hedge their portfolios and from trading houses who saw a huge opportunity in taking commissions from, and subsequently trading against, individual speculators.

So, at the request of a reader, I am going to do a series of articles on hedging, punctuated by the election or anything else that comes up in the meanwhile.

To begin, I'll discuss put hedging.

Basic put hedging for long stock holdings is the simplest hedging strategy. Long puts can have advantages in some situations but they are by and large ineffective as a continuous or long-term strategy.

Here are the basic pros and cons of put hedging:

Pros of put hedging:

- Long puts hedge a stock price all the way to zero from the selected strike price.

- Long puts have positive gamma (they get more effective the further down the underlying stock falls).

- They are an easy hedge to implement, provided of course that they are available on your target stock and relatively liquid.

- ITM puts can be an effective short-term hedge, though they are more capital intensive.

- Puts can hedge a portfolio as well as individual stocks if purchased on a broad ETF.

- There is no danger from early assignment, as with calls.

- You keep any dividends and you can still write calls on the stock as well.

- Put hedging toward the end of a year can protect a capital gain on a stock position into the next tax year.

Cons of put hedging:

- ATM and OTM puts are less expensive but have low delta (less than -.5), which is not very efficient. As such, they represent expensive insurance. Over medium-to-long periods of time, they become very costly and are not effective as an ongoing hedging strategy.

Example: NVDA closed at 139.34. To purchase a 139-strike put for 9 days costs about 4.25. That would be 3% of the stock price for just one week, or 124% annualized. If you just wanted to protect yourself from a drop lower than 130, you would need to purchase the 132 puts for 1.75 (see next bullet), which would be 1.3% (50% annualized). - To protect a stock below a specific price, you have to purchase a put at a higher strike to account for the loss of premium you paid for the put.

Example: On a $100 stock, purchasing a 90-strike put makes your maximum loss 10 points plus the premium you paid for the put. - There can be a tax consequence for hedging with an in-the-money put: If you have not held the underlying stock for at least one-year when you purchase the put, the put is considered a "constructive sale" and can cause the clock to stop on the stock for qualifying as a long-term holding for capital gain purposes. So, you may want to run your strategy by a tax pro before implementing or read up on the exact rules.

- Puts can be somewhat illiquid, further increasing the cost of using them.

If you are going to use a long put as a hedge with nothing else, buying an in-the-money put is actually the preferred way to implement the strategy. It can give you a very high degree of downside protection with less cost in time value. It will require a larger capital outlay, but less of that outlay represents the actual cost of the hedge in time value. As a hedge, therefore, the ITM put is more efficient than an ATM or OTM, though it also closes off any possible upside until the stock rises beyond the strike of the put.

Example: Using NVDA again, a 9-day put at the 150 strike is around 11.50. Most of that, however (10.66) is intrinsic value, so only .84 is the time value cost of the hedge. Your maximum loss while in that put hedge would be less than a point.

In subsequent weeks, I'll discuss call-writing as a hedge, put spreads, collars and more.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.