Pre-Earnings vs. Post-Earnings Strategies

October 17, 2024

The Markets at a Glance

SPY has continued to set new highs with the broader market (i.e. smaller caps) now carrying their weight. I've noticed a pattern lately on SPY whereby it opens very slightly up or down and then slowly climbs throughout the day. It's as if investors wait to see if there is going to be a sell-off and if not, they buy a little more.

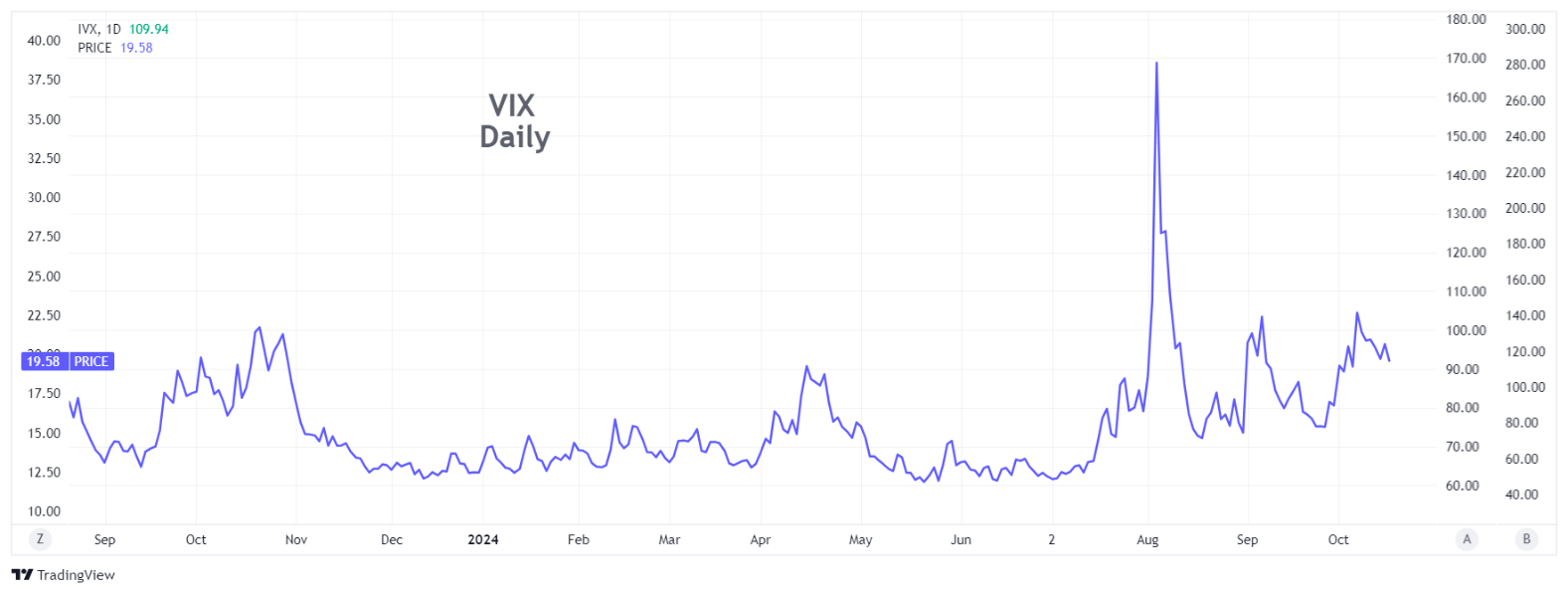

VIX crossed back below 20 but is still over 19 and holding on to that little bit of extra skepticism that some participants evidently still have.

It is looking more doubtful now that another rate cut will occur in November, but the market doesn't appear to have a problem with that, since it is interpreting it as a sign that the economy is just fine without one.

With the steady grind upward, the only bargains are coming from stocks with bad news or disappointing earnings, and some of those do present attractive opportunities (see today's strategy section for an example). It may well be that the market just marches upward or holds the line until the election, but as yet, I still don't see much of a volatility skew at all for the first week in November. So even that may be somewhat of a non-event as far as the market is concerned.

Strategy Talk: Pre-Earnings vs. Post-Earnings Strategies

Earnings announcements have always been a natural focal point for stock and option traders, as they represent the one time every three months when everyone knows there will be material information released by each company.

The activities surrounding earnings announcements are hectic but they bring increased liquidity, a specifically timed news event, and usually heightened implied volatility, all of which can work in an option trader's favor. How to play earnings releases, however, is not trivial.

The earnings game is fast and complicated, making it challenging and potentially dangerous when unexpected things happen. Experienced traders also know that it is not as simple as determining whether earnings news is going to be positive or negative per se, but whether or not it is in line with expectations, whether it is already priced into the stock, and whether there are clues about future earnings in the same announcement. Even then, it can be quite challenging to guess precisely how the market will react. We are all too familiar with stocks that sell off on positive earnings announcements or rise on disappointments.

In addition, earnings announcements are a favorite target for automated trading algorithms designed to evaluate the news and act on it quicker than humans, which they can easily do now. Humans cannot hope to compete against automated trading bots for trade speed. Worse yet, the machines react so quickly that they have been known to trade in the wrong direction at first, only to reverse seconds later when more information comes out. This can throw traders for a loop who are looking at the initial reaction and trying to jump on the trend.

The main factor for options traders regarding pre-earnings trading is that implied volatilities in near-term options will be exaggerated (though sometimes justifiably so). That allows option traders to play the implied volatility skew created by a pending earnings announcement. To play a skew where IV is higher for near-term options than longer-dated ones without being directly exposed to direction, one can sell straddles or strangles in the near-term expiration and purchase the same straddle or strangle in a more distant expiration.

Post-earnings trading is different. Once earnings are announced and a stock makes its initial price move, the excess implied volatility in short-term options drops quickly back to a more normal level. It may remain somewhat high for a few hours, but usually comes back down in the first trading day to levels more in concert with those of longer expirations.

If the stock price drops, however, implied volatility on near-term options can remain elevated, offering IV strategies to option traders. Some of these scenarios are akin to the "falling knife" situations I mentioned last week.

Once earnings are announced, the game changes from a guessing game to a reacting game with a lot of traders and market-makers unwinding their pre-earnings bets while longer-term investors and institutions react to the new information.

If the news is positive and complete (i.e. no major questions raised or left unanswered), the stock will react accordingly and research tells us such reactions can take days or even weeks to play out completely as investors gradually digest the news and make their moves. If positive news results in a sell-off, it is likely that the news wasn't quite positive enough for the anticipation that was built into the stock price prior to the announcement. This can still be medium-term positive, but not until those who overpaid prior to the announcement take their losses and move on. (Naturally, every stock is unique, so these are just guidelines.)

Once in a while, you get a negative surprise on an otherwise healthy company that creates a potential overreaction to the downside. These can represent trading opportunities and it happened this week on United Healthcare (UNH). The company announced good earnings but lowered future guidance.

What happened is shown below. The initial sell-off chopped roughly 10% off the prior closing price of the stock. So, in essence, it qualified as a falling knife. A quick assessment of the news suggested that the company was now realizing the pain of business trends that were already known in the industry, rather than a big new surprise. There also seemed to be little indication that there were more negative surprises to come.

After closing over 600 prior to the announcement, the stock hit a low about 15 minutes into the trading day and then stabilized. After that, it began a steady recovery for the remainder of Tuesday and Wednesday's trading. The panic bottom was near 543 on Tuesday and the stock closed at 571.34 on Wednesday.

The point here is that you didn't need to guess whether earnings will be positive or negative beforehand and then determine how the market would react to that news. There are hundreds of companies to consider and your odds of success are likely a toss-up in such situations at best. Such an approach cannot be consistently successful and has a lot of downside risk when wrong.

Instead, if you waited until after the announcements and looked for stocks with surprises, you could zero right in on stocks such as UNH. Once the stock had already gone down 10% and was offering rich near-term options, it offered no guarantees, but did present an attractive risk-reward opportunity for a covered call or put write.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.