Using ITM VIX Options to Hedge

September 26, 2024

The Markets at a Glance

The equity market appears to be having a "what now?" moment. The rate cut that was totally expected happened on schedule last week, though at 50 bps, it was more generous than many anticipated. While some people read that as a concern by the Fed for a potential recession, the market was clearly pleased with the more aggressive stance. Perhaps even more pleasing is the promise of more rate cuts to come and the confidence that inflation has been licked.

The news led to an immediate rally, which catapulted SPY to a modest new high, though not so for the QQQ, which is still below its mid July peak. So the September rallies do suggest that the strength broadened out a bit, but the Russel 2000 (IWM) is also still below its August peak.

In other words, the rate cut provided a very short term boost to equities, but so much of the rate cut news and the soft landing were already built into prices that the market stalled after that. So, the rate cut wasn't a sell-on-the news event, but neither was it an all-clear to new highs and beyond.

Strategy Talk: Using ITM VIX Options to Hedge

If you're thinking like me here, you may be viewing this as a 'goldilocks' market - one that has priced in the best possible scenario - managed inflation, lower rates, a healthy jobs environment, an economic soft landing, and a new type of technology that will have nothing but upside for everyone.

But if all that is already priced in, then what is the news that will power the market to the next level higher? And on the other hand, what risks (election shenanigans, more job weakness, geopolitical escalation) have not been priced in?

Markets anticipate. And this market has anticipated that the economy is perfect and AI will rule the world. That's exactly when I start to worry.

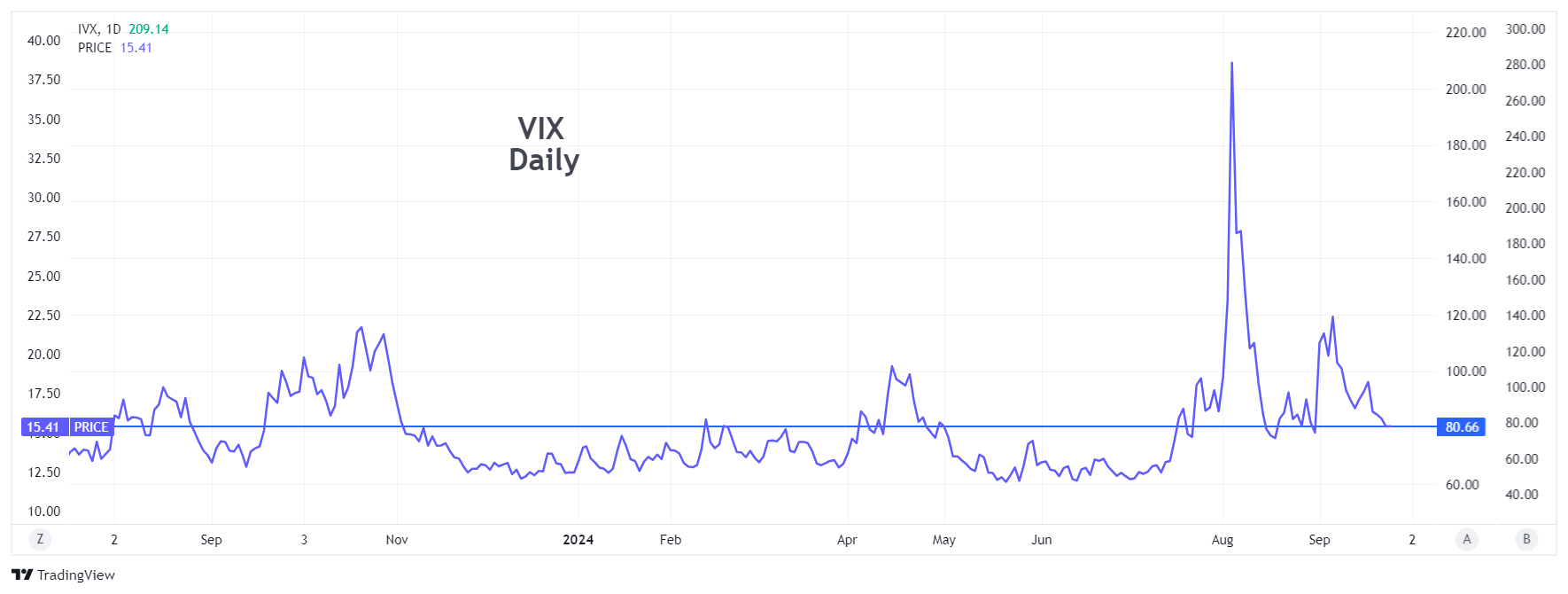

Back in June, I presented the idea that VIX calls could represent a hedge against a market downturn. With VIX back in the low 15s, this might be a good time to look at VIX call options to hedge the risks that people aren't focusing on right now.

Many people tend to view the purchase of VIX calls as a strategy for addressing tail risk, but that does not have to be its only use. If you are thinking about tail risk, you would typically be buying OTM calls such as the VIX November 30s, which will cost you $90 per contract.

That may offer some solace against a dramatic decline in the market, but in all other scenarios, that's simply a cost of protection against a whopping big drop in the market and an attendant spike upward in implied volatility. The market did give us one of those spikes back in July, but that was the first time in years. And it didn't stay up in the 30s and 40s for more than a day or two.

If you want protection against a more modest decline, the tail risk approach won't work. What if instead of the November 30 call, you purchased a November 10 call. That one goes for about $790. So, yes, a much bigger outlay. But what are the odds of a much more modest decline and a VIX that gets into the low 20s for a while?

Let's face it - VIX may not sit at 11-12 again for some time. At 15 or so, you would be mid-way between its range for most of the last year and probably have a good shot at making money from the 10 strike just from pre-election jitters, even if the market just drifts from here for a while.

Tail risk may be worth protecting against, but an OTM VIX call is an all-or-nothing-proposition that will result in a loss most of the time. Consider that the market has frequent pullbacks under normal conditions and that a different technique might be better suited to hedging those scenarios.

Got a question or any comments?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.